The unprecedented impact of COVID-19 on the global box office has raised much concern and speculation for the future of our industry. By April 5, the majority of territories shut down completely leaving less than 1% of cinemas across the globe still able to report box office figures. Now, the immediate question for most is ‘how do we recover?’

Gower Street specialises in release date optimisation via our theatrical market simulation tool FORECAST. As a film analytics company, we have been tracking the global box office loss since the outbreak began and already published our 5-stage Blueprint To Recovery which identifies the key markers of market recovery.

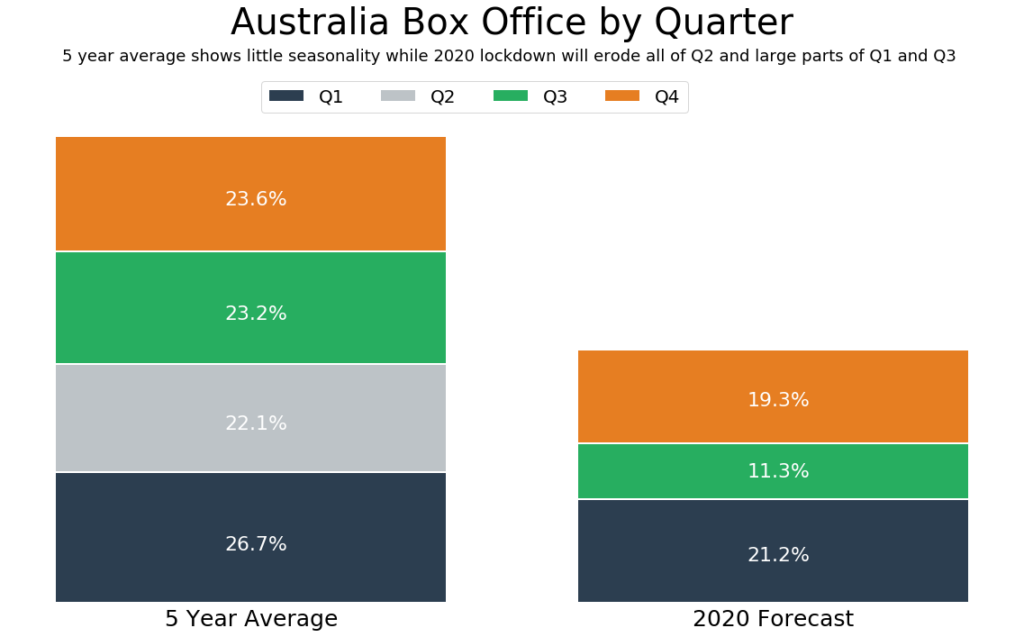

This article is focused on our analysis for Australia, exploring how far 2020 could end up behind the annual average GBO of the last 5 years. We will review the decline for Q1, the impact of the shutdown in Q2 and the potential recovery rates for Q3 and Q4.

An article exploring the end of year predictions for our remaining FORECAST territory, Spain, will be posted later this week. We have previously published articles on this topic for UK/Ireland, Germany, Mexico and the Domestic market.

As shown above, the annual box office gross of A$1.2 billion is split fairly evenly across the four quarters in Australia. Q1 is the slightly larger of the 4 quarters, perhaps due to seasonality and that much of January in Australia is school holidays. This may cause some concern for Australia’s box office recovery in 2020, as Q2 has been almost entirely wiped out by the national lockdown. Q1 also saw a small downturn this year. Australian cinemas were ordered to close on March 23, following a weekend that grossed far below average due to public uncertainty. Totalling A$258 million, Q1 only accounted for 21.2% of the 5-year average box office, rather than the usual 26.7%.

The Rise of Drive-In Cinemas

With all cinemas still closed in Australia, there has been almost no box office gross throughout Q2. However, the Yatala Drive-In based in Queensland re-opened on May 2, with the gross from drive-in cinemas growing week-on-week as a few more opened. The appetite for catalogue titles at these drive-ins appears to be complementing holdover titles such as SONIC THE HEDGEHOG and THE INVISIBLE MAN to attract audiences. On the weekend commencing May 21, DreamWorks’ 2001 animation SHREK grossed A$26k at drive-in cinemas, over a quarter of that weekend’s entire box office gross. It grossed a further A$17k the following weekend (May 28-31), when other catalogue titles such as DIRTY DANCING (30th Anniversary re-release), DAYS OF THUNDER and THE PRINCESS BRIDE saw the week’s box office gross in Australia grow to its biggest yet since lockdown began (A$213k).

However, despite the impressive success of catalogue titles, the limited number of these cinemas means that the total box office grossed to date from drive-ins in Australia is A$500k, accounting for just 0.04% of the 5-year average gross.

Re-opening Cinemas

Over the past couple of weeks there has been increasing clarity about cinema reopening plans in Australia, which allows us to begin planning what box office recovery could look like. Some states have confirmed that cinemas will be permitted to re-open over the next couple of weeks: Northern Territory on June 5, Southern Australia on June 8 and Queensland on June 12. These 3 states account for a 22% market share of Australian box office, so it is likely they will only bring a small increase to the drive-in grosses we are currently seeing. Victoria has a 25% market share and recently announced that it will allow cinemas to reopen from June 22, so we expect to see a more noticeable increase in box office from that point. However, government guidelines permitting re-opening do not mean that cinemas will be ready to do so.

As it stands, the likelihood is that the earliest cinemas will open in any other state is July. Hoyts (22% market share in 2019) have recently announced their plan to open cinemas with a “staggered approach” from July 2. Reading Cinemas (7.8% market share) has also announced plans to re-open their cinemas in line with the permitted dates in each state. There has not yet been any comment about a re-opening date from Australia’s two other main exhibitors, Event or Village, but we feel it is safe to assume they will be looking to re-open in July also. The National Association of Cinema Operators said that it hopes cinemas will re-open across the country by mid-July.

The Five Stages of Recovery

Therefore, we are working to the assumption that the first week of July is where we should plot our rate of recovery from, starting from a low level and looking to see box office activity pick up significantly when TENET is released on July 16. To reach Stage 1 in our 5 Step Recovery Plan, Australia needs to have 80% of cinemas (by market share) open again. However, Stage 2 and 3 are slightly easier to predict. Stage 2 is when box office hits the lowest day’s box office gross from the past two years, this is a total of A$876k. Currently, without any further changes to expected re-openings or release dates, we expect to reach Stage 2 on the weekend of TENET’s release. This demonstrates that the placement of tentpole titles is a significant element of box office recovery in Australia.

We do not expect to hit Stage 3 of recovery until mid-September. Stage 3 is our base week: the first full week of operation in which box office reaches the lowest result from the past two years, a weekly total of A$12.4 million. We think it is likely that we will reach Stage 3 on the week commencing September 17, this week sees THE KING’S MAN, TROLLS WORLD TOUR, CONNECTED and THE SECRET GARDEN all opening. It also coincides with the beginning of school holidays, which should guarantee increased young audiences in cinemas during the last two weeks of September. There is of course the possibility to reach this stage earlier if tentpole titles such as MULAN or WONDER WOMAN 1984 exceed expectations, or if social distancing is eased sooner than we expect. Likewise, the success of TROLLS WORLD TOUR remains difficult to predict given the straight to VOD release in several territories earlier this year.

Currently we expect that Q3 in Australia will account for 11.32% of the 5-year average gross, nearly 12 percentage points behind where Q3 normally sits. This reduction is based on both a lack of product in the market, but also the effect of social distancing on potential box office gross.

Social Distancing

We have worked with 3 different social distancing models: strict, moderate, and relaxed, which are explained in more detail here. Our strict social distancing model means that daily box office in Australia is capped at a maximum of A$2.7 million. If this were to be applied to Australian box office from July 1 through to the end of the year, with every day hitting the cap, then 2020 box office would be -37.9% behind our 5-year average. This demonstrates just how limiting social distancing measures could be for cinema attendance. In the case of our moderate distancing model box office would be -24% behind the 5-year average, and for our relaxed model, -10.2%.

The moderate social distancing model sees the maximum day cap increase to A$4.6 million from October 1 to the end of the year, assuming that measures would be relaxed from that point. Meanwhile, our relaxed model puts daily caps in place for two months each: A$2.7 million for the first two months, A$4.6 million for the following two months, and A$6.4 million for the last two months of the year. Regardless of how social distancing measures pan out in Australia if they last for the rest of 2020, they will certainly have some effect on potential box office gross.

Interestingly, Event Cinemas recently published some research conducted by surveying 20,000 of their loyalty customers. This research indicated high levels of interest in returning to the cinema. 83% of those surveyed intended to return to the cinema within the first 3 months of opening, and 94% said they intend to visit the cinema with the same or increased frequency. However, the conclusion drawn from our social distancing model is that audience willingness to return may not be the most important determining factor for 2020 box office as some expected. Instead it is likely that social distancing could limit viewing opportunities for a willing audience.

It is also important to examine what product is in the market. Currently there are 254 titles dated for 2020 release in Australia, in contrast to 2019’s 653 releases. Only 43 of these titles are dated for a Q3 release in 2020. If we were to calculate the potential of Q3 based on estimates for the titles dated alone, with no adjustments for social distancing, we would expect their combined gross to be 16.2% of the 5-year average. As this is higher percentage than our expectations for Q3 stated above, it demonstrates again that social distancing will be the most limiting factor on box office potential for this quarter, and that any undated titles looking to release in 2020 should turn their attentions to Q4.

Christmas and the Return to ‘Normal’

The outlook for Q4 is slightly more promising. We have applied our ‘moderate’ social distancing model in FORECAST which allows more relaxed approach to social distancing in Q4. Box office would be capped at A$4.6 million per day from October onwards, meaning there is more potential for films to succeed in this period. We are currently expecting Q4 to be just 4.3 percentage points behind the 5-year average, at 19.3%. This would constitute a Q4 gross of A$234.8 million, only A$36.4 million behind Q4 in 2016, which had ROGUE ONE, FANTASTIC BEASTS, SING, MOANA and DOCTOR STRANGE in the market.

Whilst Q4 this year has tentpole titles in the form of NO TIME TO DIE, BLACK WIDOW, SOUL, TOP GUN MAVERICK, THE CROODS 2 and DUNE, there is a noticeable absence of a large franchise title like STAR WARS in the Christmas period. This could be attributed as another reason why we expect to see Q4 box office fail to reach our 5-year average.

For Q4 to have the potential bring box office levels back to ‘normal’ we’d need to see more tentpole titles dated and a further relaxation of social distancing. As previously noted, Q4 is one of the smaller quarters on average, in terms of box office. Therefore, Q4 box office would have to exceed our average to compensate for gross lost throughout the year, which seems unlikely based on the reasons we have explored.

We do however expect to reach Stage 4 and Stage 5 of our 5 Stage Recovery Plan during Q4, and the points at which we hit each stage again demonstrates the reliance on strong tentpole titles for the box office to recover. Stage 4 is the first full week to achieve a median level of business based on the past 2 years, in Australia this is a week gross of A$21.5 million, which we expect to reach on week commencing December 24. This week sees a strong collection of titles released for adult and family audiences on December 26, including TOP GUN MAVERICK, THE CROODS 2, SOUL, PETER RABBIT 2, DUNE and TOM & JERRY. We expect to hit Stage 5 the following week, anticipating continued strong business from those titles. Stage 5 is an equivalent performance to those in the top quartile of weekly business from the past two years, a week gross of A$26.6 million. We reached these predictions by implementing our analysis on the rate of recovery in FORECAST, so there is of course scope for these estimates to change.

End of Year Prediction

To get to our predicted end of year (EOY) total we needed to implement a reasonable rate of recovery, that is, the rate at which we think weekly grosses will grow and is effectively a measure of consumers’ willingness to return to the cinema. Our Lead Data Scientist, Dr Iain Rodger, has created a model that takes the EOY expected drop, re-opening market percentage, and 5-year average GBO (per week) to calculate the corresponding growth rate.

We factored in our recovery rate, re-opening market percentage, and social distancing caps, to calculate that 2020 ending at -48.2% less than the average annual GBO of A$1.2 billion is achievable based on each day hitting its full potential. This would translate into approximately A$586 million annual gross for 2020.

Of course, this prediction relies on several changeable factors, and our analysis is something we will continue to revisit and adjust throughout the year as cinemas re-open and we have more information at our disposal.