The unprecedented impact of COVID-19 on the global box office has raised much concern and speculation for the future of our industry. By April 5, the majority of territories had shut down completely leaving less than 1% of movie theaters across the globe still able to report box office figures. Now, the immediate question for most is ‘how do we recover?’

Gower Street specialises in release date optimisation via our theatrical market simulation tool FORECAST. As a film analytics company, we have been tracking the global box office loss since the outbreak began. We have already published our 5-stage Blueprint To Recovery which identifies the key markers of market recovery.

This article, focusing on Spain, is the final one in our current series estimating 2020 box office recovery in key major markets. We analyse the impact of the pandemic on Q1 and the shutdown in Q2, before looking at the potential recovery rates for Q3 and Q4 to assess how far 2020 could end up behind the annual average gross box office of the last 5 years.

Our previous articles can be found here: UK/Ireland, Germany, Mexico, Australia and Domestic.

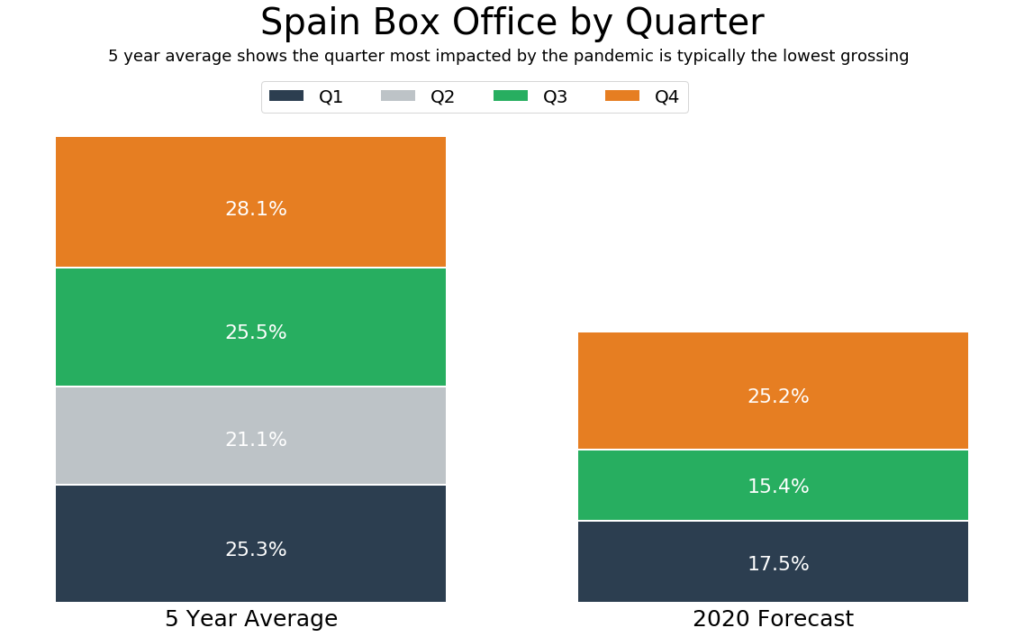

In Spain, the annual average GBO (€594 million) is split across the four quarters as follows: Q1 representing on average 25.3%; Q2 21.1%; Q3 25.5%; and Q4 28.1%.

Largely due to the downturn in cinema attendance from the beginning of March, to the rapid closures of cinemas nationwide from March 14, Q1 2020 grossed €103.9 million – 17.5% of the average annual GBO vs the 25.3% it usually represents.

Q2 has been mainly lost to the lockdown cinema closures. Despite drive-ins being cleared to operate from May 15, only 6 have been operating to date. From May 29 ‘COVID-free’ regions were also allowed to re-open, though again the actual amount of locations remains small, with only 16 traditional cinemas currently reporting box office. It is expected the majority of cinemas will not open until June 26. Based on this, we expect Q2 to represent less than 1% of the average annual GBO.

Estimating the rest of 2020

To establish our end of year prediction, we began by creating a ‘best case’ scenario for Q3 & Q4. For Q3, we added up all the titles with a lifetime GBO estimate over €500k dated within this period (as of June 8). Assuming each title reaches its full lifetime estimate (estimates based on pre-COVID / fully functioning market), Q3 would represent 18.4% of the annual average. If we assume that Q4 performs as though unaffected and represents the average 28.1%, 2020 would be 35.6% behind the average annual GBO.

Working from this ‘best case’ scenario we then needed to incorporate the potential impact of less product in the market compared to previous years, and the impact of social distancing measures on capacity to reflect current market conditions.

2020 Current Calendar

As of writing this, only 358 titles are dated for 2020 compared to the 670+ each previous year (2015 being the exception with 569). Of that, 76 titles are currently dated for Q3 2020 with 24 holdover titles from Q2 (though these are predominantly made up of catalogue titles for limited engagements), compared to 2019’s Q3 which saw 202 new release as well as 134 holdover titles. Q4 2020 currently has 43 titles dated compared to 2019’s 263.

Given this lack of product compared to previous years, and taking into consideration audience’s willingness to return to cinemas, we needed to calculate a re-opening market percentage that would reflect these differences in the current market to historical years. We calculated this to be 10% of the historical average for the same date.

To get from this re-opening percentage to our EOY prediction we then calculated a reasonable rate of recovery, that is, the rate at which weekly grosses will increase and is effectively a measure of consumers’ willingness to return to the cinema. We believe that this is likely to be product driven and will continue steadily, reaching a return to full confidence by the end of the year. Our Lead Data Scientist, Dr Iain Rodger created a model that takes us from our re-opening percentage to an end of year total. This uses the EOY expected drop, re-opening market percentage, and the 5-year average GBO per week to estimate the corresponding growth rate.

Social Distancing

We addressed capacity restrictions by employing social distancing day caps, working with 3 different models explained below. More information on how we have calculated the caps can be found here.

Strict: If strict social distancing measures were applied everyday between July 1 – December 31 (so every day capped at €1.8m), and every single day reached that cap, 2020’s maximum potential would end up 26.4% behind the average annual GBO.

Moderate: If we incorporated our moderate cap of €3 million a day from October 1 to December 31, the year’s maximum potential would be sitting 7.8% behind the annual average GBO.

Relaxed: If we incorporated all 3 caps from July to the end of the year (so, strict cap July 1 – Aug. 31, moderate Sep. 1 – Oct. 31, relaxed cap of €4.2m from Nov. 1 – Dec. 31) and all days hit the daily caps, 2020 would actually increase 10.6% on the annual average GBO.

These scenarios include the €103.9 million grossed in Q1, our projection for Q2, plus the maximum that could be achieved in Q3 and Q4. Of course, we recognise that it is extremely unlikely that every day will hit its daily cap, but these scenarios serve to give us a point from which to analyse how adversely social distancing measures may impact box office recovery.

While it may not make sense for Studios to move more tentpole titles onto the 2020 slate due to capacity restrictions in other major territories, the lesser impact of social distancing measures on achieving historical box office figures in Spain proves more optimistic. Strong local product, as well as Studio titles over-performing on historical comps due to space in the market, will likely be key to Spain’s recovery.

EOY projection

We have implemented the ‘moderate’ social distancing caps in FORECAST and, with the above parameters in place, Q3’s share of box office reduces from 18.4% (calculated from our estimates) to 15.4% while Q4 is estimated to achieve 25.2% of the average annual GBO. Based on each day hitting its full potential, we estimate that 2020 ending at 41.5% behind Spain’s average annual GBO is achievable. This would translate into approximately €347.5 million GBO.

Hitting the 5 Stages of Recovery

STAGE 1 – 80% (by market share) in operation.

Current indications suggest we will hit stage 1 either week commencing 26 June or early July.

STAGE 2 – box office hitting the lowest day’s box office gross from the past two years.

For Spain this would mean grossing or surpassing €260k. We forecast hitting this marker at the same time we reach stage 1.

STAGE 3 – first full week of operation where box office reaches the lowest week’s box office gross from the past two years.

For Spain this would mean hitting or surpassing €6.8 million in one week. We forecast reaching this stage week commencing August 7 which sees PADRE NO HAY MAS QUE UNO 2, GREENLAND, THE EMPTY MAN, and THE ROOM opening.

STAGE 4 – First full week to achieve a median level of business based on the past 2 years.

For Spain this equates to grossing at least €11 million in one week. We forecast achieving this stage w/c December 18 which sees DUNE, PETER RABBIT 2: THE RUNAWAY, and COMING 2 AMERICA opening.

STAGE 5 – equivalent performance to those in the top quartile of weekly business from the past two years.

We anticipate hitting this stage, which requires grossing at least €13.2 million, the following week on w/c December 25, with the openings of THE CROODS 2, TOP GUN MAVERICK, WEST SIDE STORY, and TOM & JERRY.

Our EOY prediction relies on several changeable factors. We will continue to track and react as cinemas re-open and more information becomes available to us.

All data accurate as of June 8. Historical data supplied by Comscore.