For the first time this year global tentpoles have been released widely on a nearly weekly base in March. As a result the International (excluding China) and Domestic markets recorded their best months of the year so far, leading to a global box office of $2.54 billion in March. This is +23% above the same month last year and -21% below the three-year (2017-2019) pre-pandemic average.

This pushes the global box office up to $7.9 billion at the end of the first quarter, coming in +2% above the same period last year after being behind -6% a month ago. That makes it the third best quarter since the start of the decade, just behind Q3 (-21%) and Q2 (-7%) last year.

As an encouraging development Q1 was also up +16% on the past quarter (Q4 2023). The final quarter of last year marked a turning point in the post-pandemic recovery process after the first three quarters of 2023 each topped the other to be the highest grossing quarter since 2019. It was the first quarter that was fully effected by the six months lasting strike in Hollywood, which reduced the dominating US-titles on offer, limited the marketing of releases for the time of the actors’ strike and caused a slowdown of the post-pandemic recovery. Despite still being challenged with a spare release calendar, Q1 this year was able to avoid a further downturn.

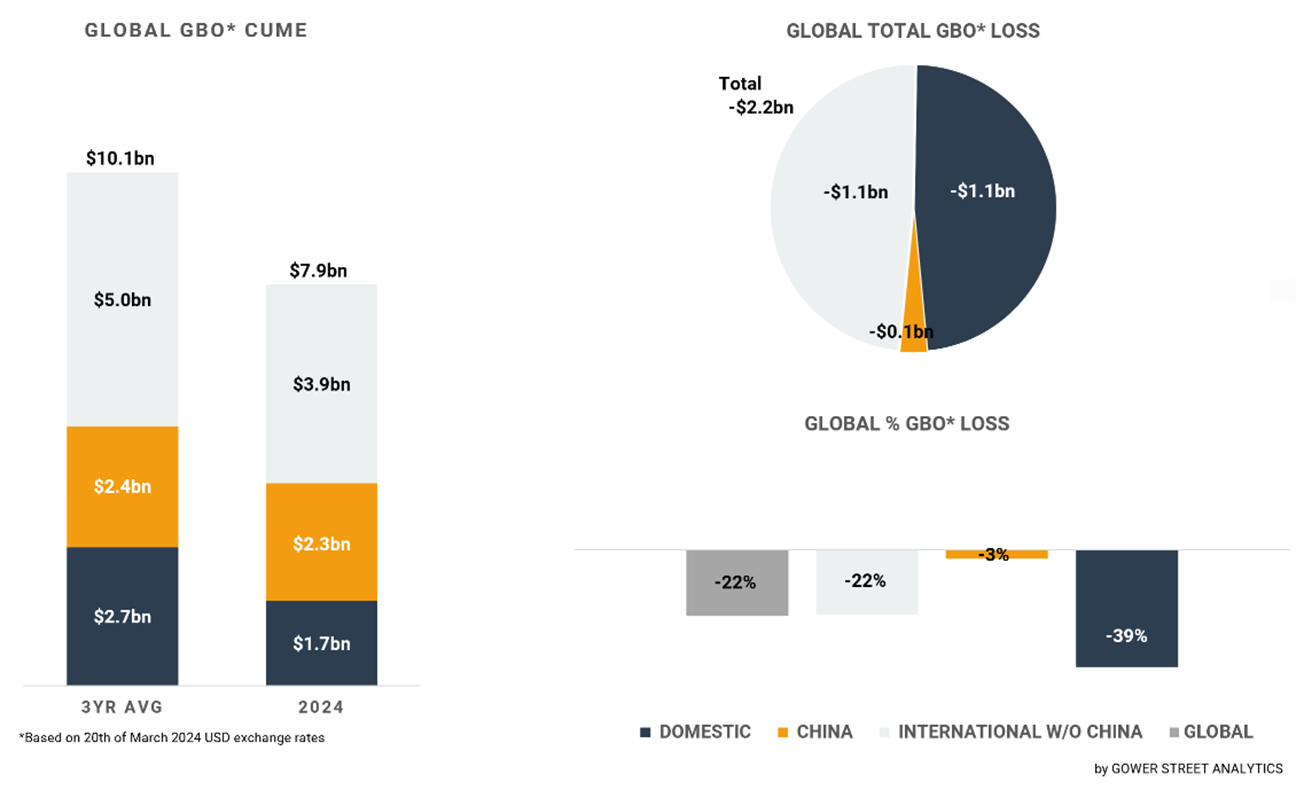

On this month’s GBOT (above), the stacked bar graph on the left shows total box office levels split out by the three key global markets: Domestic, China and International (excluding China). The pie chart indicates the current deficit compared to the average of the three pre-pandemic years (2017-2019) and where those losses are currently coming from. The bar graph on the bottom right displays the percentage drops globally.

Four worldwide released tentpoles dominated the global box office in March. The top three titles each grossed more within the month than the highest grossing global release in January and February this year.

DUNE: PART TWO was clearly the highest grossing movie at the global box office within the month. DUNE started its rollout in the final days of February. It added approximately $602 million for a cume of $626 million at the end of the month. That is already significantly above the pandemic hit first DUNE, which grossed $402 million (+56%) back in 2021. At the beginning of April, it will surpass WONKA ($632m) – another Timothée Chalamet-starring Warner release – to become the highest grossing global title since OPPENHEIMER ($965m) and BARBIE ($1.45bln) released in July last year! DUNE: PART TWO will most likely end in the ballpark of IT ($705m) and FAST X ($709m). A bit below THE BATMAN ($772m), which opened in the same window two years ago.

The second highest grossing global release in March was the Dreamworks Animation sequel KUNG FU PANDA 4 with $347 million. That is already above the running lifetime of MIGRATION ($292m), which was also distributed by Universal. Based on its current performance it will finish ahead of other successful recent Dreamworks’ sequels like PUSS IN BOOTS: THE LAST WISH ($485m) and HOW TO TRAIN YOUR DRAGON: THE HIDDEN WORLD ($525m). As well as above the last KUNG FU PANDA instalment ($521m), but behind the first two (KFP1: $632m, KFP 2: $666m). That would make KUNG FU PANDA 4 the highest grossing animated release since SPIDER-MAN: ACROSS THE SPIDER-VERSE ($691m) last June, surpassing ELEMENTAL ($497m).

On the final weekend of March another hit by Warner arrived with GODZILLA X KONG: THE NEW EMPIRE. It roared to impressive $194 million in just five days to become the third highest grossing title of the month. At that early stage of release, it looks like it will overtake the past two instalments of the MonsterVerse franchise, GODZILLA VS. KONG ($470m) and GODZILLA: KING OF THE MONSTERS ($387m). It might still stay slightly behind the initial GODZILLA ($528m) from 2014 and KONG: SKULL ISLAND ($569m). That’s also above recent Warner sequels MEG 2: THE TRENCH ($398m) and AQUAMAN AND THE LOST KINGDOM ($436m). Further, that would put GODZILLA X KONG ahead of JOHN WICK: CHAPTER 4 ($441m) and ANT-MAN AND THE WASP: QUANTUMANIA ($476m), which were both major releases in the first quarter last year.

The quartet of March’s major tentpoles is completed by Sony’s GHOSTBUSTERS: FROZEN EMPIRE. The newest part in the long running franchise contributed $109 million in the month. At the end of its run, it will most likely get in the ballpark of the two recent franchise entries GHOSTBUSTERS: AFTERLIFE ($205m) and GHOSTBUSTERS ($229m) from 2016. That is also the level of DUNGEONS & DRAGONS: HONOR AMONG THIEVES ($209m), which released in a comparable window last year.

Fuelled by this set of tentpoles the Domestic market saw a significant upswing in March. A single title crossed $200 million within a month for the first time since August last year with DUNE: PART TWO reaching $253 million. It was also the first time this year that a title crossed even $100 million within a month. March had two movies reaching that level as KUNG FU PANDA 4 achieved $152 million. Still the breadth of successful releases is relatively low. March had just 6 titles grossing more than $20m. This is up from 4 in February, but still the second lowest number since May last year.

Overall, the Domestic box office generated $762 million in March, which is the second highest grossing month since August last year. Just a glimpse behind December (-2%). March is up +16% against the same month last year and behind -26% on the three-year pre-pandemic average.

The March result couldn’t avoid the first quarter falling short and recording the lowest grossing Domestic quarter since Q1 in 2022 (+22%). The $1.67 billion is -5% behind last year at the same time. A gap to the three-year average of -39%!

As North America, the sub-region of Latin America had a March that was substantially better than the first two months of the year. It was the highest grossing month for the sub-region in the past eight months. The -11% gap against the three-year average was the smallest of the three sub-regions. For the whole quarter Latin America still has the widest with -25%. It’s the only sub-region, whose cume is behind the last year at the same time (-5%).

The sub-region of Europe, Middle East, and Africa (EMEA) had a slight opposite dynamic. While in the month of March it was having the widest gap of the three sub-regions with -15%, the first quarter of the year had the smallest gap of them with -21%. EMEA also recorded the second-best quarter since the start of the decade, just behind Q3 last year (-10%)!

The regional performance was again led by the Netherlands being +6% above the three-year average, one of only two tracked top 15 markets to be ahead of its pre-pandemic average after the first quarter of 2024. Modestly up +4% on the same period last year. Germany follows being behind the pre-pandemic average by -13%. France is down -25%. Both are also trailing past year’s Q1 with -5% and -9%. Other major EMEA markets are up on that with Italy (+25%), UK/Ireland (+7%) and Spain (+3%). Nevertheless, all three are still showing more severe gaps to the pre-pandemic benchmark (UK/Ireland -29%, Italy -29%, Spain -33%).

The second territory of the tracked top 15 market that performed above pre-pandemic level in Q1 was Japan at +3% up. That is +12% up on Q1 last year. Japan led the sub-region of Asia Pacific (excluding China) to a quarterly result around the same level as EMEA with a -21% gap against the three-year benchmark and +5% uplift on the prior year.

March was even better. Asia Pacific grew +29% on the same month last year, the best among the sub-regions. The main driver was an exceptional month for South Korea, which was +46% above March last year and +2% above the month’s pre-pandemic benchmark. Local blockbuster thriller EXHUMA reigned the month with an impressive $53 million. The cume stands at $80 million, which makes EXHUMA already the third highest grossing release in South Korea since November 2019, just behind THE ROUNDUP ($104m) and AVATAR: THE WAY OF WATER ($107m). The volatile market is still -30% down on the three-year average at the end of Q1, but +11% up on last year.

China had a weaker March. It was the third lowest grossing month in the past twelve. Nonetheless, its $386 million was significantly up on the soft March last year (+46%). The number #1 title of the month was Taiwanese production THE PIG, THE SNAKE AND THE PIGEON grossing $87 million. This was followed by two global releases: DUNE: PART TWO grossed $46 million, which is already higher than the lifetime of the first part (+27%), while GODZILLA X KONG: THE NEW EMPIRE grabbed the third spot with $44 million. This is a very good number for a US release in China in recent years. However, it recorded the second lowest opening of the five MonsterVerse movies.

Elevated by the successful Chinese New Year period in February the first quarter just missed the three-year average benchmark by -3%. It’s the third best quarter in China since the start of the decade and +6% up on Q1 2023.

The global box office in 2024 is standing around the same level as last year at the same point in time (+2%). In year four of a challenging recovery journey that is a growth rate that is far from ideal, given that the global cume is still over a fifth behind (-22%) the pre-pandemic levels. Though, considering that we lost roughly 50% of production time in 2023 due to the strikes in Hollywood the expectations were lowered already. On the back of that the first quarter came in at the top end of our modest prediction. The majority of global releases fulfilled their potential. Strong local and international titles around the world leveraged the gap in individual markets. To keep up with the prior year and even grow in the next two quarters will be at least as difficult as in the first. The two highest grossing quarters of the decade set a high benchmark last year.