For over two months the film industry around the world has been waiting for a sign. Something to suggest the potential for a return to normal operations. While cinemas around the world are slowly re-opening in some markets there have been media stories of slow progress in bringing audiences in. We’ve all been looking for an indication of positive, substantial growth. Hong Kong may now be offering that example.

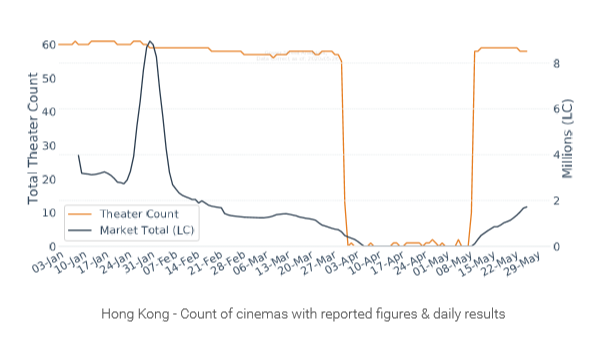

Regular readers of Gower Street’s Road To Recovery report will have noted the remarkable growth in business in Hong Kong over the past few weeks since cinemas there were allowed to re-open May 8 with restricted capacity. The local government in Hong Kong had ordered all cinemas to close from Sunday March 29.

A small market, Hong Kong was able to re-open the majority of cinemas in one go, rather than piecemeal. On May 9 approximately 85% of cinemas were back in business. These represented 80% by box office market share. May 9 immediately hit the Stage 2 marker of Gower Street’s Blueprint To Recovery for the territory – a daily box office equivalent to the previous lowest day from the past two years. BLOODSHOT led the short-week (6-day) business, with the market generating roughly HK$5.3 million ($687k) according to our partners at Comscore. New releases included Taiwanese horror THE BRIDGE CURSE and TROLLS WORLD TOUR.

The first full week of business (May 14-20) hit HK$8.6 million ($1.1m). The result showed the first full-week back achieved 46% of the Stage 3 marker of the Blueprint To Recovery – a weekly box office equivalent to the previous lowest week from the past two years. Business was led by a $417k launch week for Japanese anime title DIGIMON ADVENTURE: LAST EVOLUTION KIZUNA, despite seeing only 5 days of business having opened Saturday May 16.

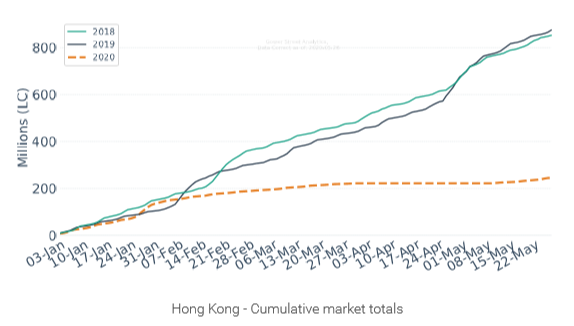

But the real excitement started to be seen this past week (May 21-27). The May 21-24 weekend was the first to deliver box office of over $1 million. This was the first time this had occurred in over three months, since the February 13-16 weekend – well before complete market closure. The full week was up 33% week-on-week taking HK$11.4 million ($1.5m) and selling over 184,000 tickets – delivering just over 60% of the Stage 3 goal (HK$18.9m). The result was 27% ahead of the February 20-27 week, which had seen both SONIC THE HEDGEHOG and THE GENTLEMEN launch.

Box office was once again dominated by DIGIMON ADVENTURE: LAST EVOLUTION KIZUNA, with another anime title, MY HERO ACADEMIA: HEROES RISING, opening in second place. Other new openers included horror sequel BRAHMS: THE BOY II, Keanu Reeves’ crime thriller SIBERIA, and the Oscar-nominated French crime thriller LES MISERABLES.

This growth is a positive sign. The audience is increasing and business is progressing well towards the first weekly goal on our Blueprint To Recovery. This is happening despite a lack of the kind of US tent-pole titles that would normally be dominating the landscape right now. The equivalent week in 2019 brought the opening of Disney’s ALADDIN, while JOHN WICK: CHAPTER 3 (in week 2), POKEMON: DETECTIVE PIKACHU (week 3) and AVENGERS: ENDGAME (week 5) were leading holdovers.

It is also happening despite social distancing and strict measures to prevent any spread of the virus being in place. The Broadway circuit, the leading chain in Hong Kong with 78 screens across 13 locations and over 40% market share, has strict preventative measures in place to prevent the spread of COVID-19. All guests are required to wear a face mask upon entering the cinema and must submit to temperature and quarantine wristband checks. They may be refused entry if they show a temperature above 37.5°C, if they are not wearing a face mask, or if they are wearing a government-issued home quarantine wristband. All staff wear face masks at all times and are temperature-checked daily.

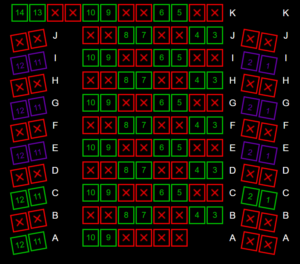

Broadway is operating at approximately 50% capacity with alternate seating implemented at all screenings. An example of seat mapping in one screen at Broadway’s MOViE MOViE Pacific Place venue is shown below (4 seats had been pre-sold for this future screening at time of sampling). Guests are required to sit in their assigned seat and may be removed if they do not. They may also be removed if they remove their face mask during the screening. The chain is not allowing eating or drinking within the screen. No morning shows are taking place to allow for deep-cleaning.

Of course, there is a long way to go. Box office in Hong Kong is currently tracking a whopping 72% behind 2019 at the same stage. AVENGERS: ENDGAME in its first five weeks on release in 2019 had achieved a box office take equivalent to 90% of this year’s total result to date (in nearly 5 months).

News came this past week that Marvel Studios would re-release the original AVENGERS and IRON MAN 3 from this weekend through to June 10, to help further entice audiences back. Warner Bros has re-released Christopher Nolan’s DARK KNIGHT trilogy. Other classics, including Taiwanese romantic drama YI YI and Italian coming-of-age drama CINEMA PARADISO, are on offer alongside recent releases like Guy Ritchie’s THE GENTLEMEN, Ken Loach’s SORRY WE MISSED YOU and Oscar-winner PARASITE, as well as other new releases of independent movies including Thai comedy TOOTSIES & THE FAKE and British Jane Austen-adaptation EMMA. But to make greater strides in its progress Hong Kong will need bigger new titles to be on offer.

Each market is experiencing its own unique circumstances in this crisis. Hong Kong has been less severely impacted than many countries, with local authorities taking a stricter approach to quarantines than some other countries. Although business had already been dropping rapidly in early March as the virus spread and greater numbers of import titles were starting to move out of the release calendar, Hong Kong only saw complete closure of cinemas for five and a half weeks. The second half of March saw the greatest surge in new cases in the market, reaching a peak on March 29 – the day cinemas closed. The peak among active cases was seen on April 7 with a steady decline since and current active cases at their lowest levels in well over three months. Only 22 new cases have been reported since May 8. The market has reported 97% of recorded cases to have recovered, with just 4 deaths (less than 0.4% of recorded cases).

What is working in Hong Kong might not work for all, but the evident growth is a much-needed positive sign for the whole industry. Audiences are returning in greater numbers each week despite, or perhaps because of reassurance brought by, strict virus prevention measures greeting them on arrival. They are doing so for a slate of films that could never normally be dominating May box office. Hong Kong’s cinema audience appear hungry to return for whatever is on offer and the market is making significant progress towards Blueprint To Recovery markers before the release of any major tent-pole titles.

Gower Street is tracking what is happening around the world; Comscore-tracked markets in all regions: North America, Europe, Latin America, Asia Pacific; every US state and Canadian province; 29 international territories. We are already starting to see more positive-growth signs: both in individual US states and in other international markets besides Hong Kong. As business continues to grow, and other markets offer a roadmap to be followed, our Road To Recovery reports are designed to provide vital information to help the industry not only track what is happening but also determine what might be possible where you are by seeing what is happening around you.

This week we have also published a series of predictive articles for our FORECAST territories. These look ahead to what we currently expect will be possible by end of year 2020, as well as when each of the 5-stage goals on our Blueprint To Recovery is likely to be achieved. Articles focused on UK/Ireland, Germany and the Domestic market are already available. Articles for Spain, Mexico and Australia will follow later this week.

This article was original published in Screendollars’ newsletter #119 (June 1, 2020)