The unprecedented impact of COVID-19 on the global box office over the past few months has raised much concern and speculation for the future of our industry. The immediate question for most is ‘how do we recover?’. As a Film Analytics company, specialising in release date optimisation via our theatrical market simulation tool FORECAST, this question has been the driving force behind our work since the pandemic began.

Gower Street has been tracking the global box office decline since the outbreak first began impacting cinema attendance globally. By 05 April, less than 1% of movie theaters across the globe were reporting box office figures. The majority of territories shutdown completely with no indication of when they would be able to re-open.

We have been using this time to not only track, but also predict what global recovery could look like and have already published our 5-stage Blueprint To Recovery identifying the key markers of market recovery. Recovery will differ per territory and is dependent on many factors, such as; capacity restrictions following social distancing measures; economic pressures; audience willingness to return; differing re-opening plans per exhibition chain; and lack of product in the market.

In this article, we discuss our analysis on how far 2020 could end up behind the annual average GBO of the last 5 years. We will review the decline for Q1, the impact of the shutdown in Q2 and the potential recovery rates for Q3 and Q4.

This article explores these steps for Domestic, we have already published one for the UK and Germany. Further articles will be published in the next coming week to cover each of the major territories we curate in FORECAST: Mexico, Australia and Spain.

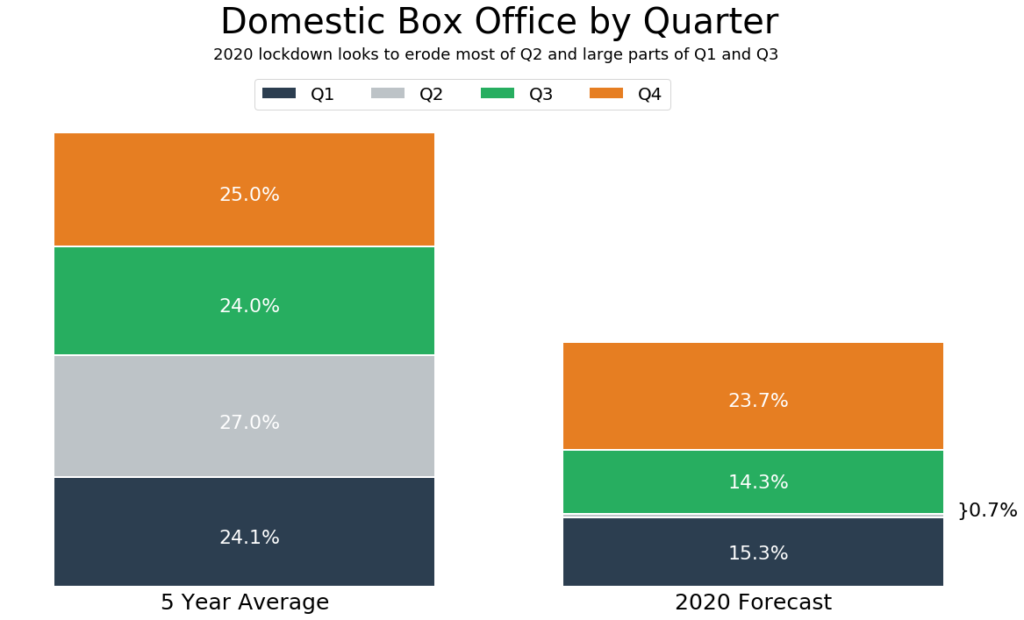

Looking at the last 5 years (visual above), Domestic’s average annual box office totals $11.2 billion and is split fairly evenly across Q1 24.1%, Q3 24.0% and Q4 25.0%. Q2 (April – June) however represents the highest share of 27.0% and will be significantly impacted in 2020 by the domestic shutdown.

Our partners at Comscore reported that during the first two months of 2020, Domestic box office consistently tracked ahead of 2019 reaching $1.5 billion by the end of February (3% ahead of 2019). From the weekend of 13 March just a week after the debut of ONWARD and THE WAY BACK, figures began to fall due to the Coronavirus outbreak. Shortly after, major exhibitors announced the closure of movie theaters until further notice, starting with Regal on 17 March. Studios also stopped reporting box office figures from 20 March. As a result, the first quarter ended with a Reported total of $1.7 billion accounting for 15.3% of the average annual box office vs the average 24.1%.

Since the closures, several states have been successfully operating Drive-Ins. Some state governments also began to ease restrictions, granting permission for movie theaters to open from 01 May.

Most cinema operators including AMC and CINEMARK (two of the largest operators in the States, collectively representing around 40% market share based on 2019) confirmed that they would remain closed until July due to safety and the lack of new content regularly available to show prior to that time. However, a number of independent theaters and smaller chains have been willing to take the plunge.

As the number of theater re-openings have grown, the weekend of 15 May had a significant increase in box office generating $2 million from $975k the weekend before. As of Memorial Day weekend (beginning 22 May) there are now 417 movie theaters in operation (including Drive Ins). The total gross for the weekend was $3.2 million, an increase of 56% from the previous. In total, Q2 has so far generated $11.3 million, 1% of the average over the last 5 years. If box office continues to grow at the current rate for the rest of the quarter we could see it potentially reach 6.5%.

Estimating the rest of the year

Now we know how we are currently tracking; what about the rest of the year? Although the official re-opening of businesses is going to continue to differ per region, state and province, we expect to reach Stage 1 of the Recovery Process (that is when 80% of theaters by market share are open again) between mid-June and the start of July, ready for the release of UNHINGED (03 July) and TENET (17 July).

To establish an end of year prediction, we began by creating a ‘best case’ scenario for Q3 by adding up all the titles with a lifetime GBO estimate over $10m dated within this period (as of 28 May). If, we assume each title reaches their full estimate (estimates based on pre-COVID / fully functioning market) Q3 would represent 17.4% of the annual average for that quarter.

It is important to note that the number of releases in the calendar for Domestic has declined significantly during the Pandemic (see our interactive infographic here). In 2019 a total of 104 titles were released by a major studio including 28 titles in Q2 and 21 titles in Q3. This year currently totals only 66 titles from a major studio. Only 15 are dated within Q3 but the number evens out during Q4 with 30 titles releasing vs 32 in 2019. The number of Mini-Majors have declined further, in 2019 a total of 109 titles released, 31 in Q2, 28 in Q3 and 27 in Q4. This year only amounts to 43 titles in total to date, 7 in Q2, 11 in Q3 and 6 in Q4.

We have taken into account the lack of movies dated for Q3 and the anticipated staggered reopening of cinemas, calculating a re-opening market of 5% of the historical average from mid-June. We then established a reasonable rate of recovery, that is, the rate at which weekly grosses will increase and is effectively a measure of consumers’ willingness to return to the cinema. We believe that this is likely to be product driven and will continue steadily, reaching a return to full confidence by the end of the year. Our Lead Data Scientist, Dr Iain Rodger created a model that takes us from our re-opening percentage to an end of year total. This uses the EOY expected drop, re-opening market percentage and the 5-year average GBO per week to estimate the corresponding growth rate.

Social Distancing

We addressed capacity restrictions by employing social distancing day caps, working with 3 different social distancing models: strict (each day capped at $30.3m); moderate ($50.3m cap); and relaxed ($70.4m cap). More information on how we have calculated the caps can be found here.

If we applied strict social distancing measures everyday between 01 July – 31 December (so every day capped at $30.3m), and every single day reached that cap, 2020 would have the maximum potential to end up 34.5% behind the average annual GBO. If we incorporated our moderate cap ($50.3m) everyday from 01 October – 31 December the year could be 26.5% behind. Finally, if we incorporated all 3 caps from July until the end of the year (so strict 01 July – 31 Aug, moderate 1 Sep – 31 Oct, relaxed 01 Nov – 31 Dec) 2020 could end up as little as 7.6% behind.

Of course, we recognize that it is extremely unlikely that every day will hit its daily cap, but these scenarios serve to give us a starting point to work with. We decided to implement the second scenario mentioned above in FORECAST, applying strict social distancing measures from mid-June to October ($30.3m) and moderate social distancing measures ($50.3m) from October until the end of the year.

With these parameters in place, Q3’s share of box office reduces from 17.4% (calculated from our estimates) to 14.3% which indicates that we are over maximum capacity for that quarter with strict social distancing measures in place. Q4 is estimated to achieve 23.7% of the average annual gross for that quarter. Therefore for the whole year, incorporating all our totals from Q1-Q4 2020 is expected to reach $6.1 billion, 46.2% smaller than the average.

We will reach Stage 2 (crossing over $6.3m for the day) prior to Stage 1 on Saturday 13 June during the first week of release of GREENLAND. Stage 3 ($111m for the week) is achieved the week of 24 July, the opening week of MULAN, Stage 4 ($202m for the week) the week of 6 November (opening week of BLACK WIDOW) and Stage 5 ($253m for the week) on the 20 November (opening week of SOUL, GODZILLA VS KONG). This result supports our initial belief that recovery is likely to be driven by major titles.

Of course, this prediction for the EOY and the 5 Stages relies on several changeable factors which we will continue to monitor throughout the year and adjust our predictions accordingly.