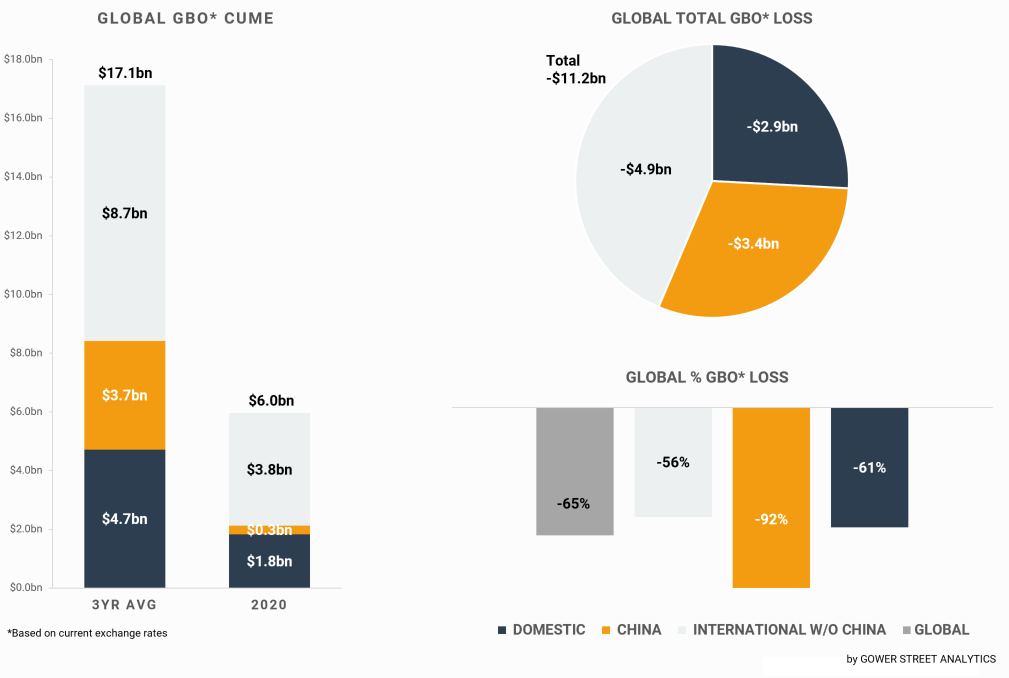

In May the global box office saw a second consecutive month with losses growing more than $3 billion when compared to an average of the past three years. Gower Street’s Global Box Office Tracker shows estimated losses in 2020 of $11.2 billion through May 31 with total box office now just $6.0 billion compared to an average $17.1 billion for the past three years at the same stage.

However, the total loss was slightly reduced with April having added $3.4 billion compared to $3.1 billion in May.

The total gross for 2020 has also started to grow very slightly. There was, unsurprisingly, no notable change between the end of Q1 and April 30 despite a handful of international markets remaining open to some degree. With business tentatively starting to resume in both the domestic market and some international territories (Netherlands and Austria were among the latest to re-open this past week) the total global box office (in rounded numbers) grew from $5.9 billion to $6.0 billion during May.

This monthly report looks at daily figures for 2020 across global markets and compares them against the average figures in each market for the past three years to track current deficit levels and how the make-up of the global deficit changes over time.

Global Box Office Tracker to May 31

The stacked bar graph on the left shows total levels split out by the three key global markets: Domestic, China and International (excluding China). The pie chart indicates the current deficit compared to the average of the past three years and where those losses are currently coming from. The bar graph on the bottom right shows the percentage drops globally.

The Domestic market witnessed the percentage of loss, compared to the average, increase from 51% at the end of April to 61% by the end of May. Total loss once again expanded by $1 billion for the second month in a row to $2.9 billion.

Losses across the International market (excluding China) expanded $1.5 billion during May, compared to $1.8 billion during April. The percentage of loss increased from 47% to 56%.

China’s percentage of loss has seen relatively little change (92% vs 91%) given that the loss of the lucrative Chinese New Year week back in January, at the start of the current crisis’ influence on the movie industry. However, with cinemas across the #1 international market still closed actual box office loss is still increasing – by $0.5 billion in May (compared to $0.7 billion in April).

As more movie theaters, states, and countries re-open through June, working toward a hoped-for mass return in July, we can hope we will see a further slowing in the coming months. Germany, which has already seen a number of states re-open, continues to do so through June with Bavaria planned for June 15 and Berlin June 30. France will allow cinemas to re-open from June 22; Italy a week earlier. Several Australian states will also commence re-openings this month. The UK will have to wait until at least July 4.

All markets will naturally implement capacity restrictions. Some re-opened markets with such restrictions in place, including Hong Kong, New Zealand and Norway, are already seeing some positive progress in results despite these limits and a lack of major new titles.

Gower Street continues to track re-openings and growth across all key international markets and in every US state and Canadian province in our Road To Recovery reports. The Global Box Office Tracker features each week in the International version of the report.

This article was original published in Screendollars’ newsletter #120 (June 8, 2020)