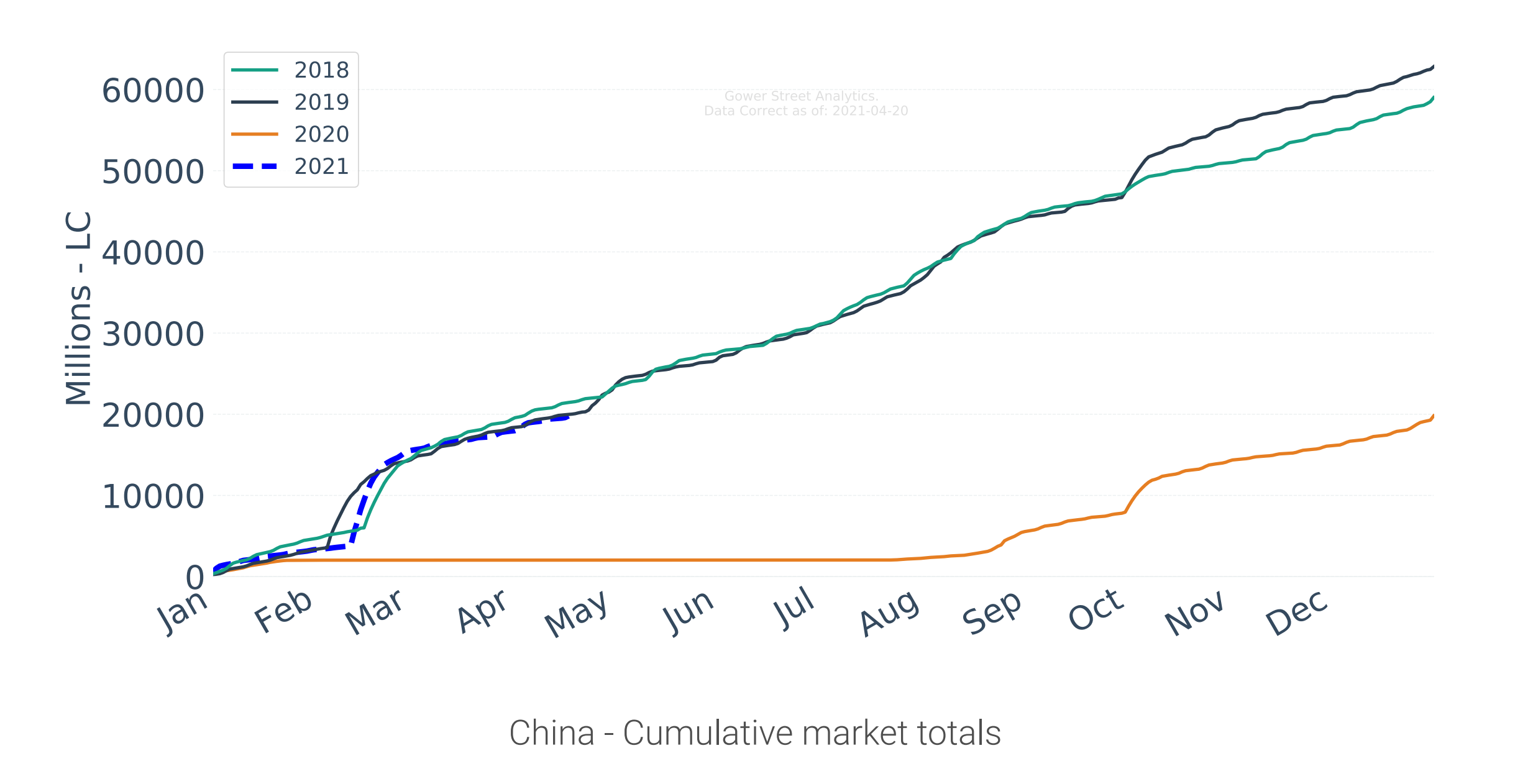

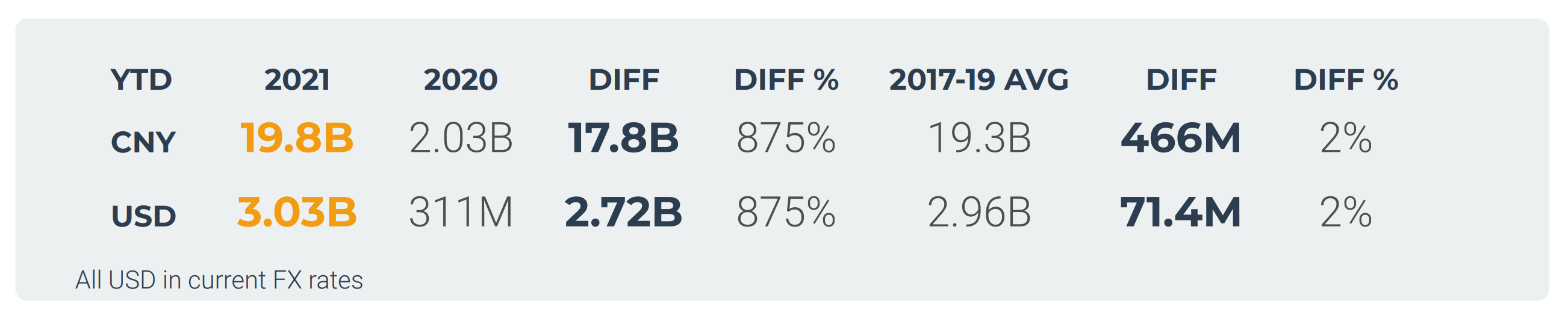

Fast track! China needed just 3.5 months in 2021 to achieve its entire 2020 box office. It becomes the first Comscore-tracked market to do so. As of this past Saturday, April 17, China generated a year-to-date box office of ¥19.8 billion ($3.03bn), the equivalent of last year’s total.

In 2020, China was the first market to close cinemas due to the COVID-19 outbreak between Jan. 23-July 20, 2020 for a full six months. Even considering this, 2021 required 2.5 months less than the prior year to produce the same box office amount.

The main driver was the record-breaking performance during the historically lucrative Chinese New Year season. Contributing the biggest play-week in China ever with ¥8.5 billion ($1.3bn) over the holiday week (Feb. 12 – 18) in 2021. The host of new titles on offer for the holidays, catering to all audiences, pushed the monthly total to a new all-time record for single-month box office in the market, ¥12.2 billion ($1.9bn). An impressive 62% of the current year-to-date cume.

The graph above shows weekly business in China across the past year, from May when the market was closed, through to April 15 2021. In the background we can see the market share of open theaters operating. The three key stages of Gower Street’s Blueprint To Recovery are marked on the graph to identify week’s were these three recovery benchmarks were first achieved.

Since the CNY record month, the market has cooled down. Two play-weeks even ended below the Stage 3 level of Gower Street’s Blueprint To Recovery (measured as a weekly box office result equivalent to the lowest grossing week in the previous two pre-pandemic years). This, however, was less a sign of a general downwards trend but more the normal reaction of a recovered market. An understandable ebb and flow dependent on the release calendar, which had dried up slightly after being flooded in February.

The Qingming Festival play-week of April 2 saw China performing above Stage 4 (measured as a weekly box office result equivalent to a median box office week in the previous two years) again. Reaching 88% of Stage 5 (measured as a weekly box office result equivalent to those in the top quartile of weekly business in the previous two pre-pandemic years). Local success drama SISTER (now $121m) opened strong that week at #1 whilst robust holdover GODZILLA VS KONG (now $177m) was at #2.

China is currently tracking 2% ahead of the year-to-date average of the three pre-pandemic years (2017-2019). From a global perspective China is running far ahead on the road to recovery, accounting for nearly two third (62%) of the current 2021 worldwide cume of $4.9 billion! Based on the historical average the share would just be shy of one fourth (24%).