The Year of the Ox brought bullish results as Chinese audiences came out in force for the Chinese New Year weekend. Holiday celebrations in the newly-crowned #1 global market delivered the biggest box office weekend on record with a colossal ¥4.5 billion ($697m). This came despite much of the country still operating under 75% (or lower) capacity restrictions.

To put this result in perspective, the entire global box office for January only came to $1 billion. The CNY weekend delivered 70% of those numbers in just three days in a single country!

Having missed out on Chinese New Year in 2020, with cinemas forced to close only two days prior to the holiday, Chinese audiences clearly showed they were keen to return for the holiday, traditionally China’s biggest box office week, this year. The result is a further triumph for China which has been steadily rebuilding its business following a six-month long shutdown in 2020 between January 23 and July 20.

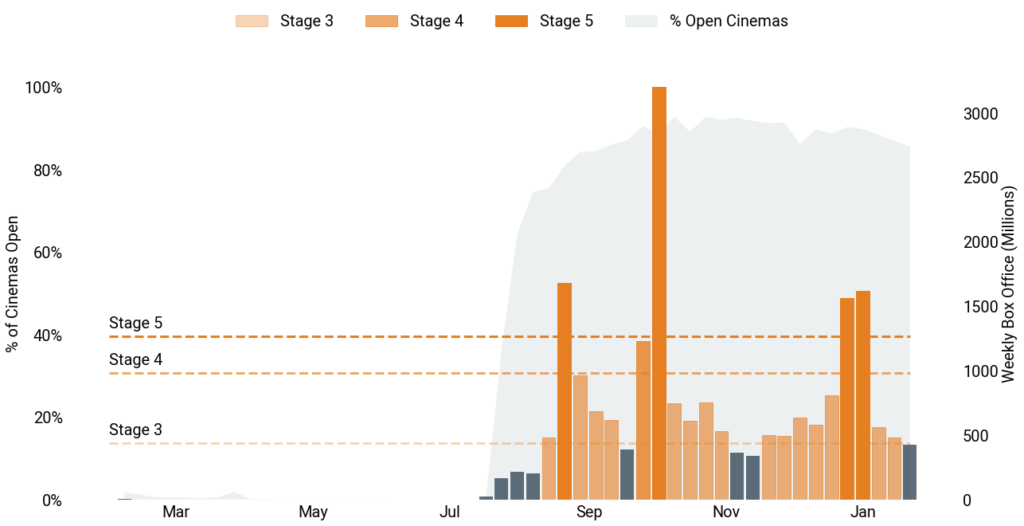

The graph below shows weekly business in China across the past year, from when the market was forced to close, just ahead of the January 25 Chinese New Year in 2020, through to the end of January 2021. In the background we can see the market share of open theaters operating. The three key stages of Gower Street’s Blueprint To Recovery are marked on the graph to identify week’s were these three recovery benchmarks were first achieved, but also to show what level of consistency there has been in China’s business following re-opening.

Cinemas were closed for a full six months between Jan. 23-July 20, 2020 with China truly beginning its road to recovery in mid-August. The Aug. 14 play-week achieved Stage 3 on China’s Blueprint To Recovery (the equivalent business to the lowest grossing week in 2018-2019). The following week saw China become the first global territory to hit both Stages 4 (equivalent to a 2018-2019 median week) and 5 (equivalent to a 2018-2019 top quartile week). All three achievements were largely driven by 2020 global #1 title THE EIGHT HUNDRED.

Business would drop back below a Stage 3 level briefly in late September before the Oct. 2 play-week brought a 20-month high as multiple titles opened for the National Day (Oct. 1) holiday week, led by MY PEOPLE, MY HOMELAND. The October National Day (or Golden Week) holiday is traditionally China’s second biggest box office generator. That Chinese audiences in October 2020 came out in bigger numbers than for Golden Week 2019 (pre-pandemic) to deliver the best results since the then-record 2019 Chinese New Year, suggested the potential for an impressive CNY 2021 to come, as Gower Street’s Rob Mitchell discussed with Variety last week.

China then went on to record a strong start to 2021 with the year’s first play-week immediately delivering Stage 5-level business, as local titles, drama A LITTLE RED FLOWER and comedy WARM HUG, opened #1-2. It also repeated at the Stage 5 level in consecutive weeks for the first time.

However, despite the successes the graph also shows that few weeks outside the top earners were able to land above or around the Stage 4 (median) level. This might indicate the limitations, even in a market showing such strong signs of recovery, imposed by the general lack of availability of import titles.

The Chinese New Year play-week in 2021 has yet to conclude so is not shown but has once again easily surpassed the Stage 5 level, with 94% of cinemas open by market share.

There was a host of new titles on offer for the holiday, catering to all audiences, with the top seven chart positions all filled by new releases, but one undeniable weekend champion. DETECTIVE CHINATOWN 3 headed business over CNY this past weekend with a colossal $395.7 million (¥2.55bn) opening that set a new global record for biggest ever single-market opening (surpassing the 2019 Domestic launch of AVENGERS: ENDGAME – $357.1m). The previous title in the popular series, DETECTIVE CHINATOWN 2, had opened for Chinese New Year in 2018 when it topped business for the full holiday week (¥2.1bn) though not the weekend (¥974.4m – where it was outgunned by MONSTER HUNT 2). It went on to gross $540 million in total.

By the end of the holiday week, its first in release, DETECTIVE CHINATOWN 3 should easily see its gross surpass the lifetime gross of top 2020 Chinese hit THE EIGHT HUNDRED (¥3.1bn), which was the global #1 of 2020 ($461m across all markets).

Other new titles on offer for CNY 2021 included: actress Jia Ling’s directorial debut, drama HI, MOM ($161.2m); Lu Yang’s fantasy A WRITER’S ODYSSEY ($48.2m); the latest in the animated BOONIE BEARS franchise, a CNY staple, (BOONIE BEARS: A WILD LIFE – $32.8m); mobile game adaptation THE YINYANG MASTER ($24.9m); animated fantasy NEW GODS: NEZHA REBORN ($20.4m); and Andy Lau vehicle ENDGAME ($12.1m). In fact, in the weekdays following the weekend HI, MOM took over daily first place from DETECTIVE CHINATOWN 3 – something DETECTIVE CHINATOWN 2 had done in reverse in 2018 to MONSTER HUNT 2.

The CNY success stood in notable contrast to the normally strong 4-day Presidents’ Day holiday weekend in the Domestic market. Total business for the Presidents’ Day Weekend, which was concurrent with Chinese New Year this year, finished at just $13.7 million. It was also topped by a 12-week-old Thanksgiving release, THE CROODS: A NEW AGE, with $2.7 million. JUDAS AND THE BLACK MESSIAH was the top new opener at #2 with a reported $2.5 million.

In 2020, SONIC THE HEDGEHOG headed Presidents’ Day business with $70 million. The 4-day holiday weekend delivered $182.9 million across the whole market, up from, a then 15-year low, $152.4 million in 2019. In 2018, the holiday had generated its biggest ever opener with BLACK PANTHER ($242.2m), leading a $346.1 million full-market 4-day result.

China lost an estimated $5.9 billion in 2020 compared to an average of the previous 3 years. However, it significantly reduced its deficit against the average from 94% at reopening in July to 66% by year-end. China finished the year as the #1 global market for the first time. The continuing strong business to kick-start 2021 and the record results for Chinese New Year look certain to continue China’s reign as the #1 global market in 2021.