In December, global cinemas accounted for $1.1 billion box office. This is the second-best result since March and on par with August. Only October topped this with $1.7 billion. However, in December, all that glitters is not gold; global box office saw no significant positive change in trend. Like in previous months, this demonstrates the current dependency of global results on Chinese blockbusters in the absence of Hollywood studio titles.

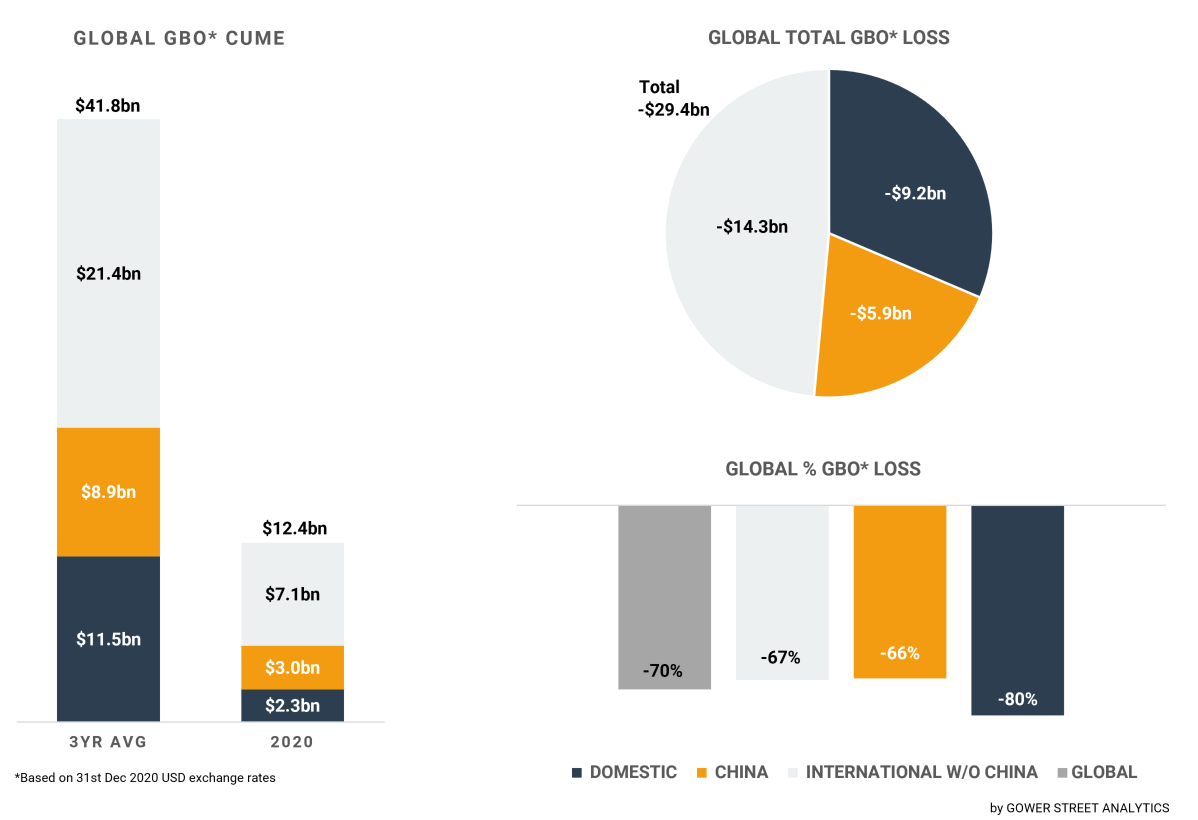

Gower Street’s latest Global Box Office Tracker (GBOT) shows that 2020 global box office grew to $12.4 billion in November, from $11.3 billion a month ago. Since the beginning of April, box office has increased by $6.4 billion. That means nearly half of the year’s total global box office (49%) had been achieved by the first quarter of 2020 (vs. 26% historically). The global box office in 2020 ends with a total loss of -$29.4 billion (-70%) against the average of the previous three years (2017-2019).

The bulk of the global box office growth in December was delivered by China with $0.6 billion (double the prior months result). It’s the second-best monthly box office of the year after October ($1 billion). That brings the cume to $3 billion by the end of 2020. Nevertheless, China finishes the year -66% below the average of the past three years ($8.9 billion) with a total loss of -$5.9 billion.

The second most box office in December was achieved across the International market (excluding China), with $0.5 billion. This is the same ballpark as in the prior months and took the cume to $7.1 billion by the end of December. International markets’ (excluding China) year ends with a total loss of -$14.3 billion against the average of the past three years ($21.4 billion), representing a drop of -67%.

The Domestic market continues to be the slowest growing, again contributing only $0.1 billion in December. With a cume of $2.3 billion, Domestic finished the year just as the #2 global territory. Losing the #1 spot to China for the first time. This 2020 result is -80% below the average of the past three years ($11.5 billion) with a total loss of -$9.2 billion.

The stacked bar graph on the left shows total box office levels split out by the three key global markets: Domestic, China and International (excluding China). The pie chart indicates the current deficit compared to the average of the past three years (2017-2019) and where those losses are currently coming from. The bar graph on the bottom right displays the percentage drops globally.

In China, the month of December saw a multitude of successful mid-size movies releasing. The highest grossing title in December was Hong Kong action title SHOCK WAVE 2, taking $91 million of its current $136 million total within the month. It led four titles that each grossed over $50m. Of the top ten films in December, eight were local productions. THE CROODS: A NEW AGE and WONDER WOMAN 1984 were the only Domestic movies among that group.

China staged a stunning comeback this year after being the first market hit. Having closed just prior to the lucrative Chinese New Year weekend in January. Following re-opening on July 20 – after six months of lockdown – their deficit against the average of the previous three years was significantly cut. From its worse, a shocking -94%, the deficit fell by a third. China became the first market to achieve Stage 5 on Gower Street’s Blueprint To Recovery in August (measured as a weekly box office result equivalent to those in the top quartile of weekly business in the previous two years) and finished the year at a similarly high level. The market’s #1 title of the year, THE EIGHT HUNDRED (released in late-August), was also the #1 film of the year globally. This is the first time a US title has not held this position.

The December performance of the International market (excluding China) was – as in November – driven by APAC, Japan in particular. Nearly 80% of the International box office in December was generated in APAC and half of that in Japan (49%). As a result, Japan has continued to cut its deficit against the average of the previous three years. Down from a peak of -65% in early July to -41% at the end of 2020. Among all Comscore-tracked markets this is the smallest drop. Japan was the second market to hit Stage 5 of our Blueprint To Recovery, the first to do so in consecutive weeks, and also finished the year with a Stage 5 level play-week.

The key to Japan’s success was the robust pipeline of local product. This helped make the recovery gains that proved impossible in markets more reliant on Hollywood imports. The main contributor was local phenomenon DEMON SLAYER THE MOVIE: MUGEN TRAIN. Continuing to dominate for the third month, the film has now been on top of the Japanese box office for eleven weeks in a row. By the end of 2020, DEMON SLAYER was the highest grossing release of all-time in Japan ($322.3m). The film also finished as the year’s #3 in Hong Kong and #1 in Taiwan, where it is now the highest grossing animated film of all-time.

While Hong Kong sadly needed to re-close cinemas for the third time on Dec. 3, other parts of APAC showed further positive development throughout the month. Following China, Japan and Taiwan; Singapore became only the 4th market to achieve the Stage 4 target on its Blueprint To Recovery (measured as a weekly box office result equivalent to a median box office week in the previous two years). Doing so on the Dec. 24 play-week. This came thanks to a trio of new openers (SHOCK WAVE 2, SOUL, MONSTER HUNTER) alongside the second week of WW 1984 (-28%). That same week finally took Australia and New Zealand to their Stage 3 goals (measured as a weekly box office result equivalent to the lowest grossing week in the previous two years), with Australia only just shy of Stage 4 (94%). Both were fuelled by #1 and #2 openings for WW 1984 and THE CROODS: A NEW AGE, respectively.

In contrast, the EMEA region continued to perform at a very limited level throughout December, delivering the second lowest monthly box office since June. Most major markets were forced to stay closed or re-closed due to the severe number of COVID-19 cases. Just two major markets (Spain and Russia) are open. At the end of December, the number of theatres open by market share across the EMEA region stayed at 24%, the same level as a month ago and a dramatic drop from a peak of 89% at the start of October. However, even in this region a positive story is to be told. UAE finally hit Stage 3 the Dec. 17 playweek with the commanding opening of WW 1984.

In Latin America, the opening of WW84 also provided some post-lockdown highlights. Nevertheless, this was not enough to give the region a significant uplift in December. The continuing high number of COVID-19 cases have caused additional restrictions, including cinema closures in Mexico, Brazil, Bolivia, Panama and Columbia in the final weeks of the month. Consequently, the number of cinemas open by market share in Latin America fell to 35% by the end of the year from a high of 63% a month ago.

Further north, in the Domestic marketplace, the situation isn’t much better. The number of cinemas open by market share has come down slightly more in the period of December to just 38% (from 41% at the beginning of the month). A substantial drop from a peak of 61% at the end of September. Despite these conditions, the first three US States (South Dakota, Utah and Wyoming) hit their Stage 3 targets – a welcome achievement.

Due to the additional cinema closures and very limited re-openings around the world, the number of global cinemas open by market share dropped further to 56% by the end of 2020. This is down from a peak of 79% at the end of September and 60% at the beginning of December. The lowest number since the middle of August, prior to TENET opening!

With 2020 closing in this state, COVID-19 will for sure further impact the theatrical landscape in 2021. Most likely more the first half, and most severely the first quarter. With vaccination rolling out over the year, the numbers of COVID-19 cases will hopefully decline. There are many global examples that people still want to get back to cinemas, provided they feel safe and the content is attractive. When the pandemic dust has settled, we will see more clearly how it has shaped global cinema. 2021 will bring at least some answers.

This article was originally published in Screendollars’ newsletter #150 (January 11, 2021).