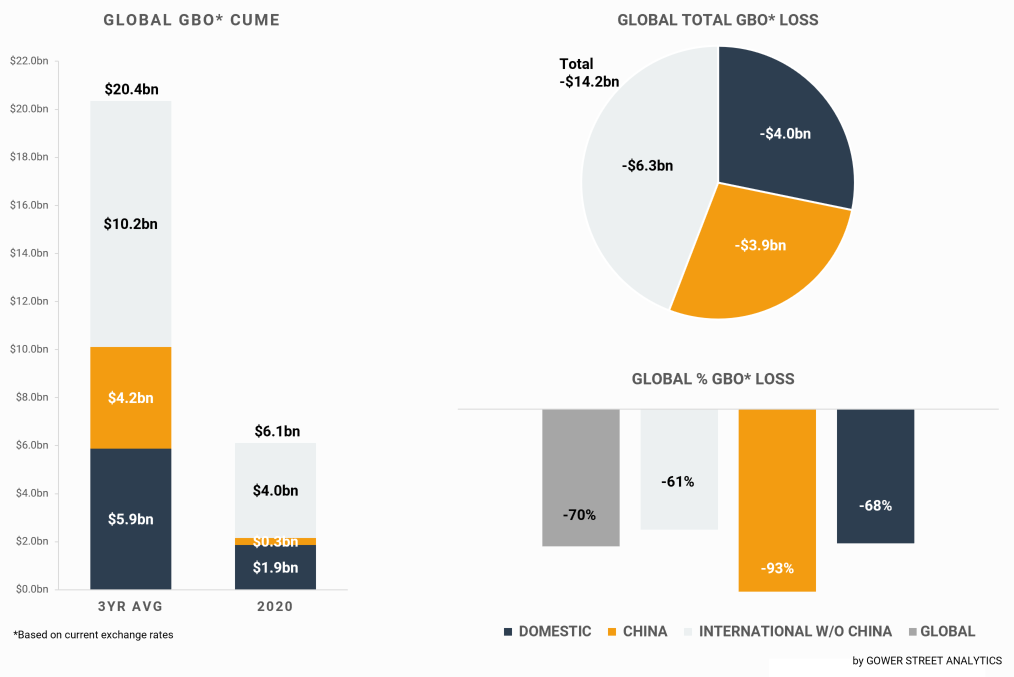

In June, the global box office saw a third consecutive month with losses of more than $3 billion when compared to an average of the past three years. At the end of the first half of the year, Gower Street’s Global Box Office Tracker shows estimated losses of $14.2 billion through June 30. Total box office now stands at just $6.1 billion compared to an average $20.4 billion for the past three years at the same stage.

Although not slowing down, the additional total loss stayed level with May at $3.1 billion. This was again below the increase in April, which added $3.4 billion to the total loss.

The total gross for 2020 has continued to grow very slightly. However, it’s speeding up; nearly tripling from $59 million in May to $143 million in June. With business further starting to resume, especially in international territories, the total global box office grew from $6.0 billion to $6.1 billion during June.

This monthly report looks at daily figures for 2020 across global markets and compares them against the average figures in each market for the past three years to track current deficit levels and how the make-up of the global deficit changes over time.

The stacked bar graph on the left shows total box office split out by the three key global markets: Domestic, China and International (excluding China). The pie chart indicates the current deficit compared to the average of the past three years again split out by key markets. The bar graph on the bottom right displays the percentage drops globally.

Domestic Loss Overtakes China

Shown on the pie chart, there has been another shift in the proportion of losses. Domestic box office losses overtook China within the last week, after the rest of the international marketplace had overtaken it in April.

By the end of Q1 China, which saw movie theaters close nearly two months ahead of the rest of the world in late January, accounted for nearly 47% of the total global loss. Now the #1 international market accounts for only 27%, Domestic for 28% and the rest of the International marketplace for 44% of the total global loss.

The Domestic market witnessed losses increase by $1.1 billion in June – slightly more than the $1 billion each in May and April. The total now stands at $4.0 billion. The Domestic percentage loss, compared to the average, increased from 61% at the end of May to 68% by the end of June.

With cinemas across China still closed, box office loss increased again by $0.5 billion in June – on par with May but slightly below the $0.7 billion in April. This loss brings the total to $3.9 billion. China’s percentage of loss has again seen relatively little change (93% vs 92%) given the huge loss of the lucrative Chinese New Year week back in January.

Losses across the International market (excluding China) expanded by $1.4 billion during June to $6.3 billion. Further slowing down after a loss of $1.5 billion in May and $1.8 billion in April. The percentage loss increased from 56% to 61%.

Positive Signs in International Markets

Despite domestic suffering a record number of new Covid-19 cases and China yet to announce a cinema re-opening day, the situation is improving in many other markets around the world. Most places across Asia and Europe have now seen the peak of the virus pass with the number of active cases dropping for a while. New markets are re-opening cinemas every week. Initial audience enthusiasm varies from very positive (France, Netherlands) to very tentative (Portugal). From these re-openings it is quickly becoming evident that global tentpole releases will be key to true recovery for the majority of markets.

Japan commonly sees major releases debut months after other markets. This has proved advantageous as it still had major Hollywood releases inbound (LITTLE WOMEN, DOLITTLE, SONIC) during June. This pushed Japan to become the first market globally to achieve the Stage 3 target of our Blueprint To Recovery. Strong local product has also helped to bridge the current content gap. South Korea had numerous local releases over the month of June (and a half-price ticket promotion). This helped the market to recover quicker than most. Until new major global releases arrive again, it is in the hands of local product to lead the recovery.

Gower Street continues to track re-openings and growth across all key international markets and in every US state and Canadian province in our Road To Recovery reports.

This article was original published in Screendollars’ newsletter #124 (July 06, 2020)