In further proof that recovery is possible, the record-breaking success of anime title DEMON SLAYER THE MOVIE: MUGEN TRAIN has driven Japan to become only the second global market to achieve a “full recovery” level on Gower Street’s Blueprint To Recovery measures. This week Japan has joined China in the rarified club of markets to have achieved the Stage 5 level of recovery.

Getting the full measure

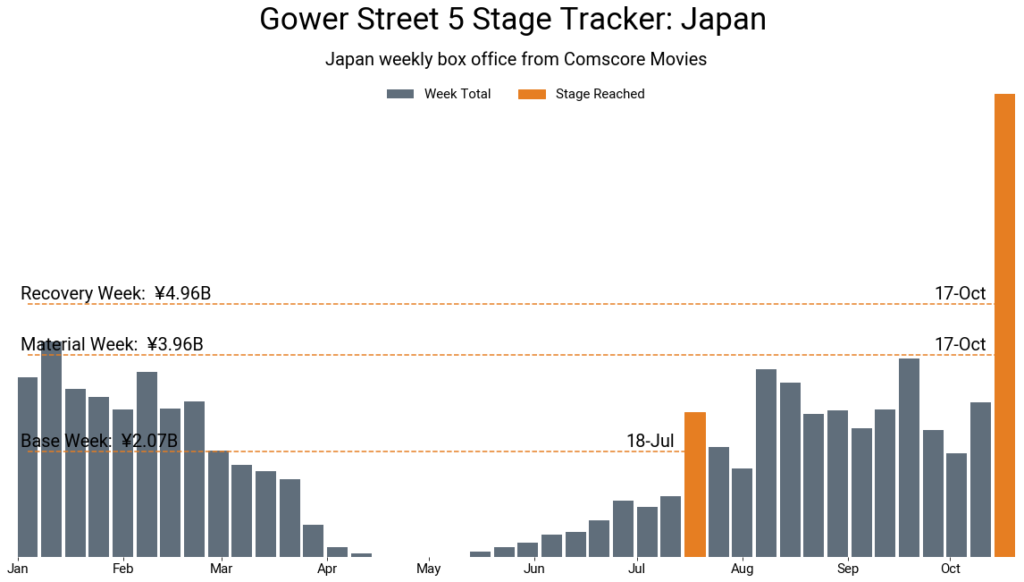

The graph above shows the Stage 3-5 box office targets of the Blueprint To Recovery for the full Japanese market. Due to reporting limitations of daily data for the full market in Japan currently available to Comscore and Gower Street, the recovery levels for the former #1 international market that are tracked in Gower Street’s Road To Recovery have to be limited to look at MPA-titles only. However, since cinemas began to re-open, following a relatively brief closure, in late May the Japanese market has been dominated by a pipeline of local product excluded from this tracking.

For this article, Gower Street has re-calculated the weekly box office stages of our Blueprint To Recovery (Stages 3-5) for Japan to consider the full market, including local product. This has been done utilising full-week reported data from our partners at Comscore Movies.

This shows that, based on full-market reported results for 2018-2019, Japan’s Stage 3 (Base) level would stand at ¥2.07 billion (equivalent to the lowest grossing play-week of the past 2 years); Stage 4 (Material week) would stand at ¥3.96 billion (equivalent to the median play-week of the past 2 years); and Stage 5 (Recovery week) would stand at ¥4.96 billion (equivalent to a week in the top quartile of the past 2 years).

Japan’s Road To Recovery

China became the first global market to achieve all five stages of Gower Street’s Blueprint To Recovery in the August 21 play-week, with local smash-hit THE EIGHT HUNDRED driving China to hit its Stage 4 and 5 targets in the same play-week.

Japan has followed a similar pattern with DEMON SLAYER. The film, which is co-distributed by Toho and Aniplex, hit headlines around the world at the start of the week following a ¥4.62 billion ($44.2bn) 3-day opening weekend. According to reported figures from Comscore the standard 2-day weekend (Oct. 17-18) delivered ¥4.08 billion ($38.9m) across Japan. This shows that the first two days of the October 17 play-week alone were enough to achieve the Stage 4 target – something only China and Taiwan had previously achieved. DEMON SLAYER accounted for over 82% market share (¥3.35bn) for the 2-day weekend.

Results for the full October 17 play-week saw the film ensure the market blew well past the Stage 5 target as well – with DEMON SLAYER single-handedly able to achieve the target level and beyond. The total market delivered ¥7.83 billion, with DEMON SLAYER maintaining its 82% market share (¥6.44bn).

While Japan, like China, has achieved both stages 4 and 5 in the same play-week, fuelled largely by a singular triumph, there was a greater difference in their Stage 3 achievements. Considering only the MPA-title box office, as featured in our Road To Recovery report, Japan was officially the first market to achieve Stage 3 with the release of DOLITTLE for the June 20 play-week.

However, that was not enough to achieve Stage 3 levels across the whole market. As seen on our re-calculated graph, Stage 3 for the full Japanese market came in the July 18 play-week with the release of another Toho film, 1980s-set high school comedy FROM TODAY, IT’S MY TURN – also the movie follow-up to a popular TV show based on a manga series. This still placed Japan at the head of the pack among markets tracked by Comscore and Gower Street – achieving full-market Stage 3 in the same play-week as other Asia Pacific markets South Korea and Taiwan. Netherlands would follow a week later. China only achieved Stage 3 the week prior to hitting stages 4 and 5, boosted by previews for THE EIGHT HUNDRED. 12 of 29 international markets tracked in Gower Street’s Road To Recovery report have achieved Stage 3. China has since re-achieved Stage 5 levels for a second play-week.

SLAYER’s Road To Success

While Toho’s cinemas in Japan have now returned to 100% capacity, requiring they only sell drink concessions and not food (those offering food must remain at 50% capacity), the success of DEMON SLAYER is remarkable. FROZEN II had been Japan’s previous biggest opener with a 2-day launch of ¥1.62 billion (3-day of ¥1.94bn) in November 2019. That is less than half of DEMON SLAYER’s opening. DEMON SLAYER is based on a best-selling manga series by Koyoharu Gotoge and is a sequel to a 2019 anime TV series.

In an article published Friday, Aya Umezu, CEO of Tokyo-based marketing strategy service GEM Partners, highlighted the role streaming had in DEMON SLAYER’s success, pointing to the fact that the film’s 2019 TV predecessor was available on most streaming platforms in Japan. She revealed that a survey conducted by GEM showed the series was the “overwhelming favourite title among movies and dramas on offer” while audiences were shielding at home and consuming more content online.

“Much has been said about the relationship between the cinemas industry and streaming services in terms of their antagonistic structure and market bite,” said Umezu. “However, this is not the case with DEMON SLAYER THE MOVIE. While theaters have refrained from operating and the number of new releases has been limited even after re-opening, streaming services have been the platform that has kept fans of DEMON SLAYER warm, building eagerness to come to the cinema for DEMON SLAYER THE MOVIE.”

Umezu suggested the success was “a great example” of how streaming services and the theatrical experience can be complimentary rather than seen as antagonistic.

Prior to DEMON SLAYER’s release, FROM TODAY, IT’S MY TURN was the highest grossing film in Japan for 2020 (¥5.34bn) ahead of Oscar-winning South Korean film PARASITE (¥4.73bn). PARASITE was released in January, ahead of the pandemic.

More Road To Travel

The success of DEMON SLAYER and Japan’s Stage 5 Recovery achievement are undoubtedly fantastic, positive news both locally and globally, but there is still a lot of road to travel. We have seen from other markets that to maintain stable recovery levels it takes more than a few powerhouse titles. The absence of Hollywood studio titles remains a problem for all global markets, even those like China and Japan with a stronger pipeline of local product than most.

Japan’s full-market box office is currently tracking approximately 60% behind 2019 at the same time, according to Comscore. This is among the lowest year-on-year deficits among international markets – behind Netherlands (51%) and Russia (56%); on par with Germany (60%), Italy (61%) and France (62%) – but still represents a sizeable loss.

In South Korea, another market largely relying on local titles, box office is tracking 71% behind 2019. News came this week that leading Korean exhibitor CJ CGV expects to close 30% of its screens over the next three years as a result of the pandemic. According to trade publication Screendaily, CJ said the decision was an “extreme measure for survival” after the crisis had taken the film industry “to the bring of collapse”. The company is also raising ticket prices.

Even prior to DEMON SLAYER’s release English-language imports had accounted for less than 26% of Japanese box office in 2020. In 2019, a record box office year in Japan, English language titles accounted for approximately 45% of total box office.

Umezu said that the latest recovery success in Japan may provide “hope for the future”, but that until Hollywood studios started to release content a sustainable recovery would not be achieved. “No matter how successful Japanese live-action films and animations are, if Hollywood films are not released there will never be a real recovery,” she said.