This week is a notable one in the recovery calendar, in large part because of what is not happening. Christopher Nolan’s TENET has not opened globally. But the week also brought growth surges in a number of international markets and a key piece of news the movie world has been keenly waiting for: China is re-opening. It was also a week where one topic became hotly debated: with US virus cases surging should Hollywood studios abandon a search for potential global release dates and prioritize the international markets where exhibitors are now struggling to keep going amid a lack of major new content?

With China and Russia returning to business, and major UK circuits ready to go, can an international August launch make sense without the Domestic market?

Europe and Asia: An Offer of Hope

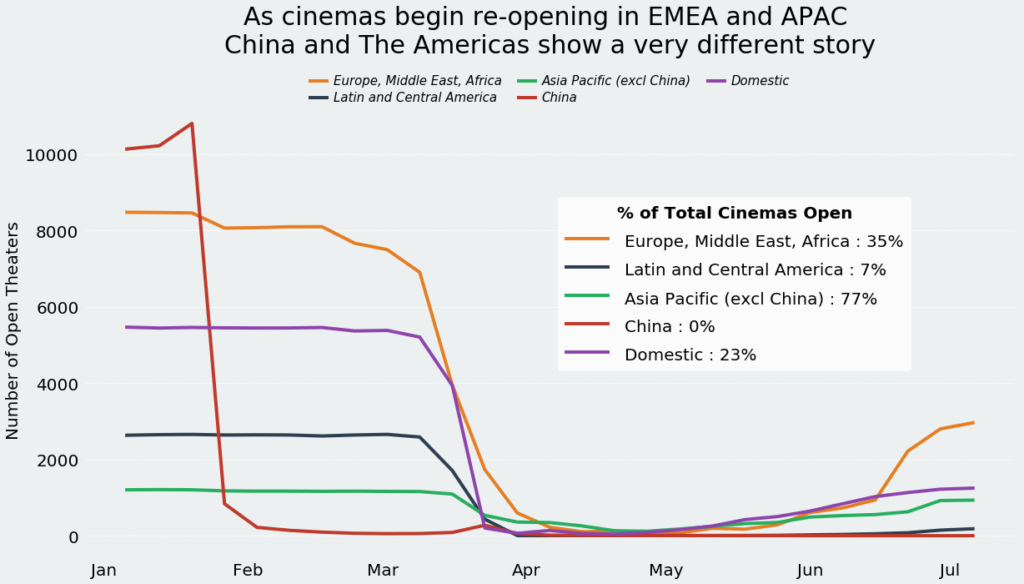

Earlier this week Gower Street’s Research Analyst, Theatrical Insights, Jamie Tonks looked at what progress has been made globally and regionally (see graph). He found that significant progress has been made since the number of global movie theaters reporting fell below 1% back in April. As of last weekend (July 10-12) 18% of global movie theaters had returned to business.

Europe and Asia Pacific (excluding China) are leading the way. Of Comscore-tracked markets 77% of physical movie theaters across the Asia Pacific region where back in business by last weekend. Across Europe, Middle East and Africa (EMEA), 35% of physical sites were back in operation.

Different World, Different Thinking

TENET provided a seemingly immoveable hope for months through the theatrical industry’s darkest period, holding defiantly on to a July 17 date for longer than most expected. When it eventually moved (first to July 31 then to August 14) a despondency set in once again across the industry. The latter move was followed by Disney’s MULAN moving from July 24 to August 21.

No-one would fault the distributors for seeking to protect properties that represent massive investment from potential disaster. However, it was not just the delay in global release of hugely anticipated titles that brought despondency, it was the loss of a symbol; the abandonment of a goal the world’s exhibitors were working toward. Once TENET, and the goal, had moved once, it was possible it would move again. Which it did. There was no longer an immoveable object providing hope. The unstoppable force was winning; uncertainty reigned once more.

Uncertainty may now represent as big a challenge as closure. Closure brought massive losses across the industry (Gower Street estimates over $16 billion to date). Now, with cases of the virus surging across the US, and in some international markets, there have been re-closures. The re-closure of Californian sites, and the possibility of other states following, has inevitably led to a presumption that August-dated releases will move once again. But is the industry being too rigid in its thinking around global releases and focusing too closely on the Domestic market, which represents a minority of global box office takings?

The past week has brought much discussion about global strategy and whether a different world, changed by COVID-19, requires different thinking. In a Los Angeles Times article of July 11 NATO president and CEO John Fithian pointed out a vast majority of global markets would be open in time for existing August release dates, saying studios would need to release movies soon or risk lasting damage to the industry. “If the answer is, ‘We’re going to wait until 100% of theaters are open’, we’re not going to be there until a year from now when there’s a vaccine,” Fithian was quoted as saying. “If we go a year without new movies, it’s over.”

This echoed sentiments expressed in a Screendaily webinar a day earlier. “If we wait for the stars to be aligned, there may not be a European cinema sector to arrive at when we get there,” said Phil Clapp, chief executive of the UK Cinema Association and president of UNIC (the International Union of Cinemas). “What we will lose in doing that is much, much greater in the grand scheme of things that some marginal reduction in revenue around a particular title. We are talking about the survival of the sector here. Piracy and marketing spend become a bit of an irrelevance.”

These are vital points. Delays to later in 2020 or early 2021 offer no more guarantee of a safe space than current dates. Cases of the virus could re-surge, as many scientists anticipate for the winter, while, without a mass-produced working vaccine or cure in place, moves to spring 2021 hardly seem assured given the global pandemic took hold across much of the globe in March and April this year. Many voices across the international industry have started to argue for a return to an inverted form of the traditional staggered release model, with international markets already in play opening titles ahead of those, including Domestic, still struggling.

The Importance of the International Market

The international market consistently represents over 70% of global annual box office – 73% in 2019. Across the top 10 titles of 2019, 9 of which grossed over $1 billion globally, international markets accounted for an average 64%. Disney’s 4 live action fantasy titles last year saw international markets take an average 69% of global takings. Marvel Studio’s 3 titles averaged 66% internationally. Christopher Nolan’s INTERSTELLAR saw over 72% of takings come from international. James Bond’s last outing, SPECTRE, achieved 77% of box office internationally. The Domestic market, still the #1 market globally, remains understandably important but should it take priority?

As Phil Clapp and John Fithian argued, continued delays in the release of major releases could have a disastrous impact on international exhibitors already able to re-open. The evidence seen in our weekly Road To Recovery reports shows audience interest waning in many early re-opening markets that are lacking new releases. If studios wait for a global release they may find a significantly reduced international market remaining, which would cause greater long-term harm.

The Opportunity of a Chinese Return

A total of 18% of global theaters open may sound low but more major markets are waiting in the wings. This week Russia, the market with the largest number of cinemas in EMEA, saw cinemas re-opening across the country. Moscow will follow August 1. The UK currently only has 17% of theaters by market share open as major exhibitors Cineworld, Odeon and Vue wait in the wings ready for a July 31 start in anticipation of major August releases. Between them the three exhibitors account for approximately two thirds of the UK market by revenue.

News also came this week that China will allow cinemas to re-open from Monday (July 20). While initially restricted to low risk areas (which excludes Beijing) things appear to quickly be ramping up since the announcement came. As reported on Deadline Friday, Universal’s DOLITTLE and Sony’s BLOODSHOT will be first out of the gate with July 24 releases. Releases are currently restricted to titles under 2 hours, which could also pave the way for MULAN (though not TENET).

China’s return could offer a strong opportunity to make an international offering in mid-to-late August, especially with Russia also back in play and the UK circuits ready to go. If China, Russia and UK/Ireland were able to bring 70% of cinemas back online over the next month then Gower Street calculates that, alongside those already open elsewhere, more than 50% of global cinemas would be back in play.

Achieving 70% doesn’t seem implausible, as our Road To Recovery reports demonstrate. Some markets, including majors Japan and France, brought back significantly more than 70% immediately. Others, like Germany and Spain, are now there after a slower start. That 50% global projection also doesn’t account for other potential market growth over the next month.

The US and Latin American markets may come later, but let’s look again at 2019. Total global box office, according to the MPA’s 2019 THEME Report, was $42.2 billion. Extracting Domestic and Latin American markets from that total would still leave 67% of global box office potential. If Canada were also included in the mix that number would rise to 69%. It will inevitably be a reduced box office, socially distancing measures in movie theaters seem certain to remain with us well in 2021, but major titles could dominate as exhibitors program multi-screens to meet demand while allowing for distancing – in Korea this week the Wednesday (July 15) opening day of TRAIN TO BUSAN sequel PENINSULA delivered a near 97% market share.

International exhibitors have been taking the first steps to recovery. Now major distributors need to join them. A global release may be impossible for a long time. But with much of Europe and Asia ready and waiting, and China and Russia coming back into play, an international release is less far-fetched and may be vital to ensure a strong international market remains for the future.

Sign up for access to our free trial of Gower Street’s Road To Recovery reports here.

This article was originally published in Screendollars’ newsletter #126 (July 20, 2020)