Understanding our industry’s road to recovery is, to put it mildly, challenging! We are on a road still under construction and the on-ramp to the potential freeway to tent-pole releases keeps getting further away. Just when we think progress is being made, surging cases present a hazard that, if we can avoid a crash, may still let air out of our tyres!

Gower Street has put together our Road To Recovery reports to help the industry better understand what has happened, is happening and, in looking at good practices in other states or markets, can happen. After all, while local news can oft times feel bleak there is positive news to be seen and potentially learned from elsewhere.

With more growth evident around the world, we are pleased to be able to announce this week that we are offering a free trial to our weekly reports through to the end of August. Two months of information on all US states, Canadian provinces, and 29 international markets across two reports. We feel now, with some positive growth and weekly progress being seen, is a time when being able to share what is going on; what is working; where there are limits, is more important than ever to us all as an industry.

What will you see?

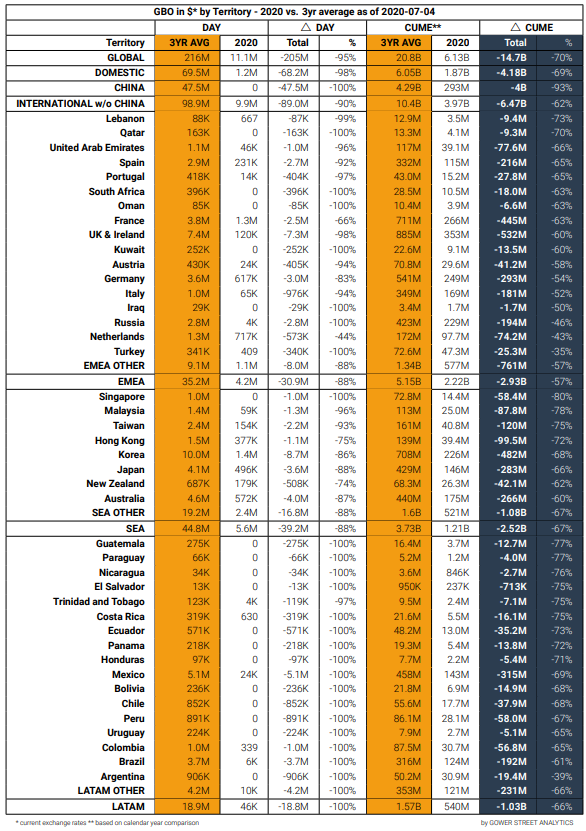

Regular readers will be familiar with some of the elements of the report. Our Global Box Office Tracker appears every week in our International report. Both reports feature comparative regional summaries comparing 2020 with an average box office of the past three years (see International example – to July 4 – below). This runs alongside Domestic and Global focused commentaries on the “state of the industry”.

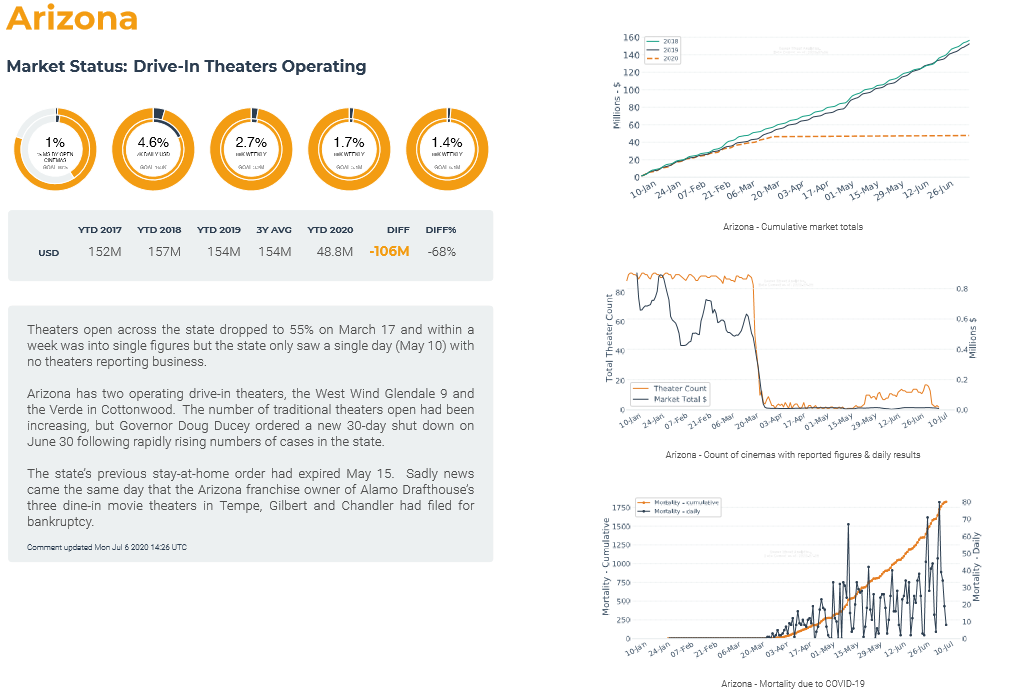

Every state, province and market-view page (see Arizona example below from last week’s Domestic report) includes three graphs for daily, localized tracking of box office compared to the past two years; the number of movie theaters open; and the localized impact of the virus. The Domestic report also includes a Domestic overview.

Our Growth Trackers, also familiar to regular readers, track progress towards Gower Street’s Blueprint To Recovery (both reports include a summary reminder of this concept). These feature alongside a snapshot box office overview of 2020 compared to the past 3 years. We also include a short, localized comment on what has happened and is happening.

What we are seeing

In the past few weeks surging virus cases in several states have resulted in some Domestic movie theater re-closures. Last weekend saw the number of theaters reporting business to Comscore top 20% across the Domestic market, but this was essentially flat week-on-week following slow but steady growth as re-closures in some states (most extremely noted in Arizona, above) counteracted further new growth in others. Internationally the story is more positive. The EMEA (Europe, Middle East and Africa) region is now up to around 32% of theaters open, while in Asia Pacific (excluding China) it is close to 75%.

The number of cases in the US topped 3 million last week and a new single-day high in the number of newly reported cases across the country was recorded on Wednesday (July 8), with previous highs recorded on both July 2 and 3. California, where the number of active cases has continually grown, has now surpassed 300,000 cases with Governor Gavin Newsom announcing a new high in daily cases recorded this week.

In Florida, the number of active cases has risen rapidly in the past month from around 45,000 at the beginning of June to 200,000. In the same time-period, Texas has gone from around 21,000 active cases to 120,000. Both topped 200,000 total recorded cases last weekend and leap-frogged New Jersey among worst-hit states in case-terms – New Jersey having seen the number of active cases falling since the beginning of June. There is better news coming out of New York, where active cases have fallen steadily (by approximately 50,000) since the beginning of July.

Internationally markets able to re-open most theaters in one, coordinated effort (Hong Kong; Netherlands; New Zealand; Japan; most recently, France) tend to show the strongest signs of recovery. But most are relying on locally produced content to fill the gap until major Hollywood releases return; a less accessible option in some markets than others. Canada is also likely to feel that squeeze.

To follow what is happening in your state, across the Domestic market, and around the world each week access your free, no commitment, trial here

This article was original published in Screendollars’ newsletter #125 (July 13, 2020)