In August, global cinemas generated a $1 billion box office. Double the box office for the four months from April till July combined. The latest update of Gower Street’s Global Box Office Tracker (GBOT) shows that the 2020 global box office grew to $7.4bn in August from $6.4bn a month ago. From the beginning of April, when it stood at $5.9bn, till the end of July, box office grew just $0.5bn. It is fair to say that the hope of recovery is starting to materialize.

However, the recovery is happening at different speeds. Half of the global box office in August was made by China with $0.5bn. It catapulted their 2020 cume from $0.3bn to $0.8bn. The other big chunk of global growth in August was delivered across the International market (excluding China) with $0.4bn, rising to $4.6bn by the end of August. The Domestic market is the slowest growing among these three, contributing only $0.1bn. Domestic box office in August increased from $1.9bn to just $2.0bn. Nevertheless, that is nearly two thirds of 2020 Domestic box office since the beginning of April ($1.8bn).

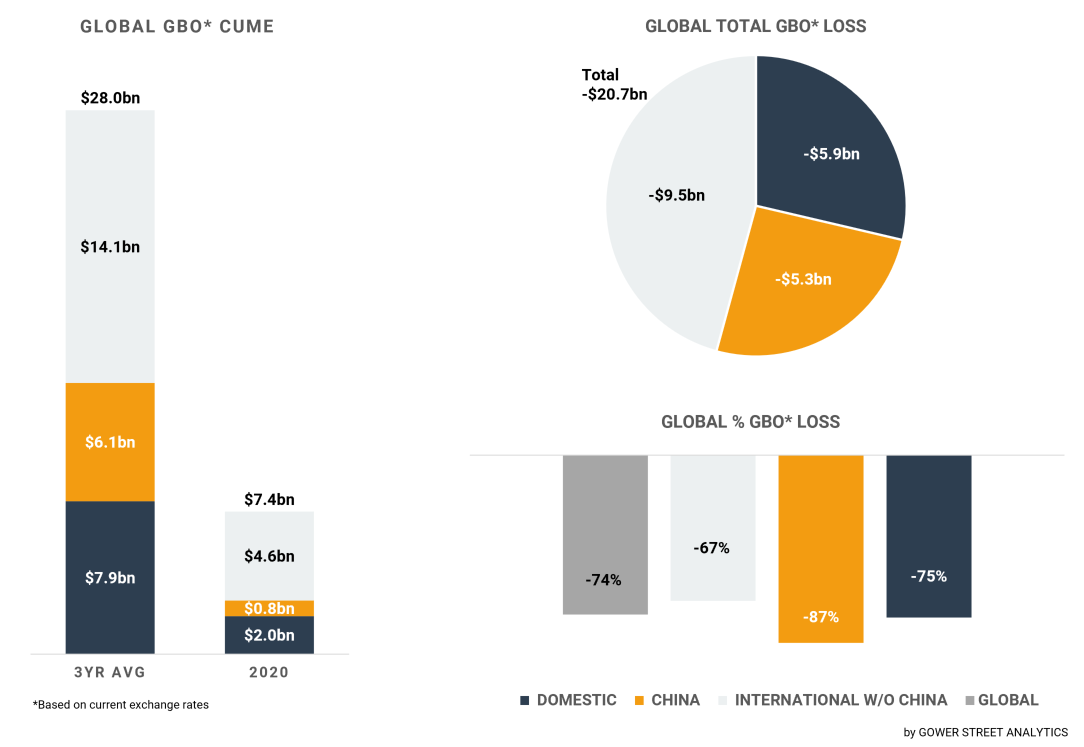

The stacked bar graph on the left shows total levels split out by the three key global markets: Domestic, China and International (excluding China). The pie chart indicates the current deficit compared to the average of the past three years and where those losses are currently coming from. The bar graph on the bottom right shows the percentage drops globally.

Given the times we’re in and the year so far, a global monthly box office of $1bn marks an important milestone on the Road to Recovery. Despite this, it is only slightly over a quarter of the August average over the previous three years ($3.5bn). This means another $2.5bn of 2020 global box office losses. Gower Street estimates that by August 31, losses will have accumulated to $20.7bn.

The growth of loss, however, has significantly slowed down. August showed the lowest monthly increase in total box office loss for all three markets since we began tracking in April. Another indicator is that the percentage box office loss, compared to the average, finally stopped increasing further in August. Globally it stayed at -74%, Domestic and International (without China) held stable around -75% and -67% respectively. China reduced from -94% at the end of July to -87% by the end of August.

An essential component of the positive development during August was the meaningful increase of open cinemas in that period. By August 31, the market share of global cinemas open was at 72%, up from 48% at the end of the prior month. Large parts of the theatrical world are now open, APAC at 91%, China at 90% and EMEA at 85%. The Americas are still at a low level of open cinemas but progressing in big steps. The market share of open cinemas in LATAM increased from 8% to 23% over the last month. The Domestic market displays the greatest improvement, up to 50% from just 14% at the end of July.

More cinemas open, and a larger crowd filling the capacity restricted auditoriums, was mainly caused by the arrival of the first major tentpoles since the COVID-19 outbreak. Firstly, the war epic THE EIGHT HUNDRED opened in China on August 21. Combined with another local hit released that week, LOVE YOU FOREVER, meant China became the first global market to achieve all five stages of Gower Street’s Blueprint To Recovery – a level that would indicate full box office recovery. Secondly, on the last weekend of August, TENET saw its long awaited successful international launch. It pushed many opening markets up to new levels on Gower Street’s Blueprint to Recovery: UK hit Stage 2; France, Italy and Germany, among others, hit Stage 3 and Taiwan crossed Stage 4. The TENET-effect was also felt more broadly than simply in terms of targets hit. Some markets saw an over-spill to other titles; holdovers were rising in business week-on-week despite the competition. This suggests a major title can bring much more than success for just that title.

This weekend, TENET opened in Domestic and additional international markets. The number of open cinemas will likely have increased again, and further growth will be visible. To sustain this encouraging momentum a constant flow of content will continue to be key.

The Global Box Office Tracker features weekly in Gower Street’s International Road To Recovery report. You can sign up for a free trial of our Road To Recovery reports here.

This article was originally published in Screendollars’ newsletter #133 (September 7, 2020).