July saw global cinemas generate over $320 million. It may be understandably difficult to see anything positive in this outcome, but it is a promising sign. That result shows July delivered a higher box office globally than the whole of the second quarter. It demonstrates, that while slow, growth is happening, and a core audience of moviegoers is returning as theaters around the world re-open.

The latest update of Gower Street’s Global Box Office Tracker (GBOT) shows the jump compared to a month ago, when the GBOT last featured in Screendollars. At the year’s halfway point global box office stood at $6.1 billion. Three months earlier at the end of Q1, when we first introduced this feature to Screendollars’ readers, box office stood at $5.9 billion. By the start of August, global box office had reached over $6.4 billion.

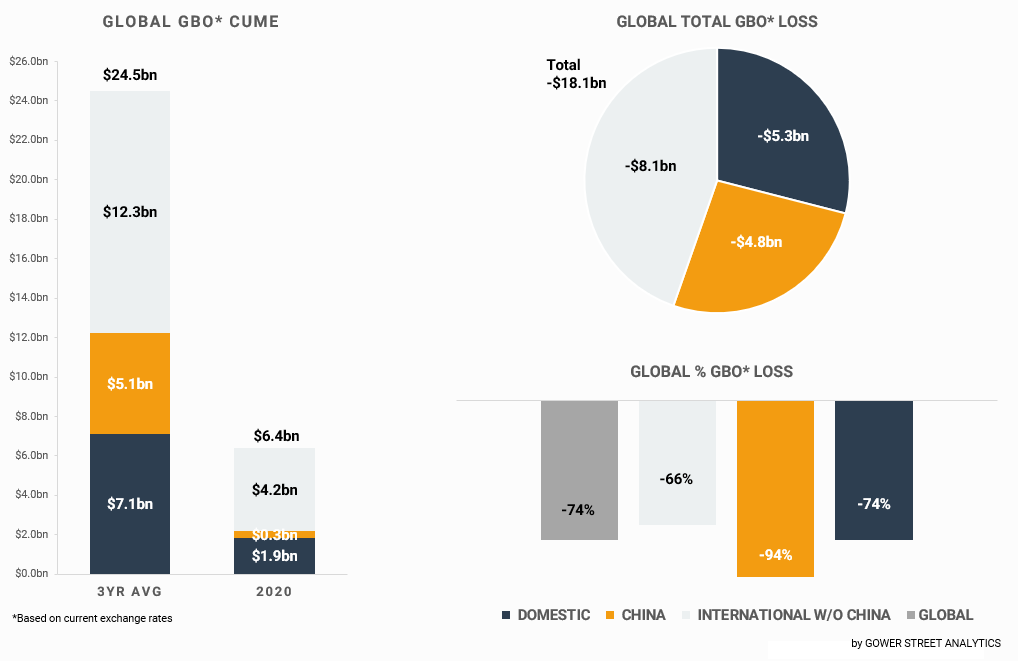

The stacked bar graph on the left shows total levels split out by the three key global markets: Domestic, China and International (excluding China). The pie chart indicates the current deficit compared to the average of the past three years and where those losses are currently coming from. The bar graph on the bottom right shows the percentage drops globally.

There is no question that $320 million is drop in the ocean compared to what we would expect to see in this key summer month – the top two new releases of July 2019 (THE LION KING and SPIDER-MAN: FAR FROM HOME) each generated a higher gross in the Domestic market alone. It is also a drop in the ocean when looking to the box office losses our industry is already facing – we would expect global grosses to nearly four times what they are by this point in the year.

The lack of major global releases to date continues to accelerate industry loss. Gower Street estimates that by August 1 global box office losses had reached $18.1 billion, compared to an average of the previous three years. The International market (excluding China) has lost over $8 billion; the Domestic market over $5 billion; and China close to $5 billion.

We all know what has been lost in these months of closures and restricted capacity re-openings. It is not possible to make up what has been lost this year. Re-scheduled titles will bring their box office in another month or another year. And those stacked titles will only take the place of others further down the pipeline, delayed due to production shutdowns. Other titles have largely or completely abandoned theatrical plans in favor of alternative platforms, most recently seen this week with MULAN to the disappointment of many international exhibitors open and waiting for new product.

But these early signs of improvement, however small, should not be taken lightly. Every week more and more positive stories struggle to be heard amid the clamor for the negative, but they are there. By August 1 the market share of global cinemas open was edging 50% (48%), boosted by growth in China (at close to 75%) and Europe (up to nearly 60% after the UK, Russia and Spain also saw significant week-on-week growth). Success stories for both local titles and imports, where available, are increasing.

This growth is there to be built on. August will see more cinemas re-opening in many markets in preparation for TENET’s planned release at the end of the month. News came this week that the Warner Bros’ film has now also set a China release a week later (Sept. 4). We expect to see these monthly box office figures improving as we revisit the GBOT.

The Global Box Office Tracker features weekly in Gower Street’s International Road To Recovery report. You can sign up for a free trial of our Road To Recovery reports here.

This article was originally published in Screendollars’ newsletter #129 (August 10, 2020).