This week Gower Street has introduced a new feature to our Road To Recovery reports: end-of-year box office predictions for our six FORECAST markets. This provides readers with our latest assessment of 2020 box office potential for the Domestic, UK/Ireland, Germany, Spain, Australia, and Mexico markets.

FORECAST is Gower Street’s theatrical market simulation tool, currently active for these six specified markets. Constantly reviewed by our dedicated film team, FORECAST enables us to react to market changes (such as release calendar moves, new social distancing guidance, etc.) to provide up to date daily and weekly estimates to FORECAST users (you can request a demonstration here). From this we can generate end-of-year (EOY) estimates for these markets (see full explanation of how we calculate for a COVID-19-impacted marketplace below).

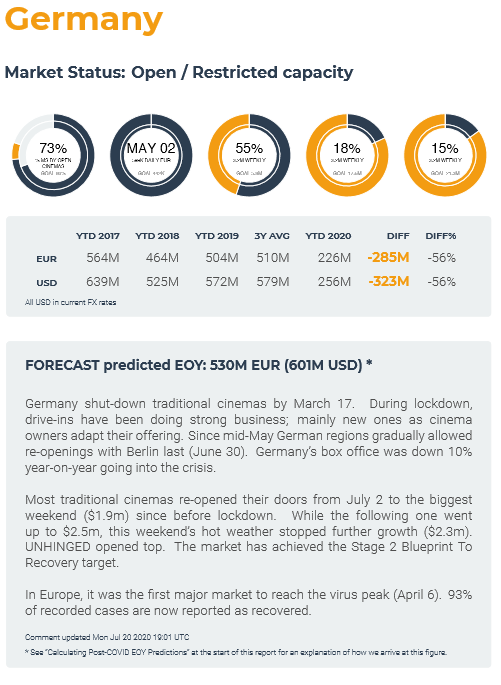

For the relevant markets the new EOY predictions can be found at the top of the comment section of the market-view pages in each report (see Germany example below, where the current estimate stands at €530m). In the Domestic Road To Recovery report it appears on the Domestic overview (page 7). In the Global report it appears on the individual market-view pages for UK/Ireland, Germany, Spain, Australia, and Mexico.

You can currently sign up for a free trial to our Road To Recovery reports, providing weekly updates direct to your inbox, until the end of August.

How does it work?

To establish an end of year prediction, our team of analysts began by creating a “best case” scenario for Q3 & Q4. To do this, we calculated the potential gross by totalling our estimates for the films still due to release in 2020. We used thresholds appropriate for each territory, whilst also assuming that they will reach their full estimate (estimates based on pre-COVID/fully functioning market).

Working from this “best case” scenario we compared the current state of the market to previous years in order to estimate what percentage of the usual market capacity we expect to re-open at. Recovery will differ per territory and is dependent on many factors, including; capacity restrictions following social distancing measures; economic pressures; audience willingness to return; differing re-opening plans per exhibition chain; and lack of product in the market.

To get from this re-opening percentage to our end-of-year (EOY) prediction we calculated a reasonable rate of recovery, that is, the rate at which weekly grosses will increase and is effectively a measure of consumers’ willingness to return to the cinema. Our belief is that this is likely to be product driven and will continue steadily, reaching a return to full confidence by the end of the year. Our Lead Data Scientist, Dr Iain Rodger created a model that takes us from our re-opening percentage to an EOY total. This uses the EOY expected drop, re-opening market percentage and the 5-year average GBO per week to estimate the corresponding growth rate.

We addressed capacity restrictions by employing social distancing day caps, working with 3 different social distancing models: strict, moderate, and relaxed. More information on how we have calculated the caps can be found here. Our caps have been implemented in accordance with the latest government guidelines for each territory.

If we assume that every single day reached their daily caps, we can calculate 2020’s maximum box office potential. Of course, it is extremely unlikely that everyday will hit its daily cap, but running these scenarios serve to give us a starting point to work with.

We fed our day caps into FORECAST along with our re-opening market percentage and rate of recovery to reach a final EOY figure.

Of course, these predictions rely on several changeable factors which are being monitored and adjusted continuously.